Navigating New Mexico State Taxation and Revenue: A Comprehensive Guide for 2024

Are you struggling to understand the complexities of New Mexico’s state taxation and revenue system? Whether you’re a business owner, a resident, or simply curious, navigating this landscape can be daunting. This comprehensive guide aims to demystify the New Mexico state taxation and revenue system, providing you with the knowledge and resources you need to stay compliant and make informed decisions. We’ll delve into the core concepts, explore different tax types, highlight key regulations, and offer practical insights to help you confidently manage your tax obligations.

Unlike many superficial resources, this article offers a deep dive into the subject, drawing upon expert analysis and a commitment to accuracy. We aim to provide a trustworthy and authoritative resource that you can rely on. By the end of this guide, you’ll have a clear understanding of the New Mexico state taxation and revenue framework and the tools to navigate it effectively.

Understanding the Fundamentals of New Mexico State Taxation and Revenue

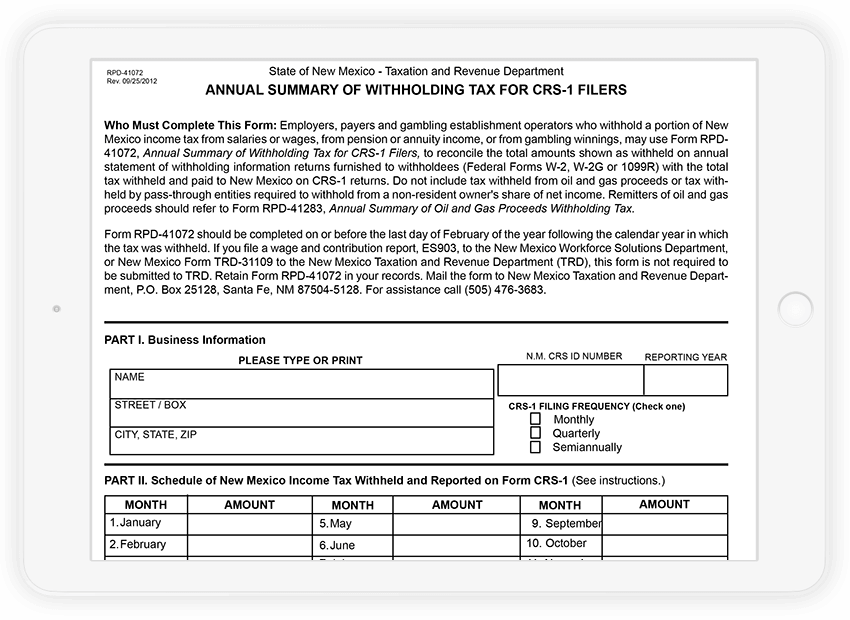

The New Mexico Taxation and Revenue Department (NMTRD) is the state agency responsible for administering and enforcing New Mexico’s tax laws. Its primary mission is to collect revenue efficiently and equitably to fund essential state services. Understanding the NMTRD’s role and the overall structure of New Mexico’s tax system is crucial for anyone operating within the state.

The Role of the New Mexico Taxation and Revenue Department

The NMTRD plays a vital role in New Mexico’s economy. It is responsible for:

* **Collecting Taxes:** The NMTRD collects a wide range of taxes, including gross receipts tax (GRT), income tax, property tax, and excise taxes.

* **Enforcing Tax Laws:** The department ensures compliance with tax laws through audits, investigations, and other enforcement activities.

* **Providing Taxpayer Services:** The NMTRD offers various services to taxpayers, including online resources, educational materials, and assistance with tax filings.

* **Distributing Revenue:** The NMTRD distributes tax revenue to state and local governments to fund essential services such as education, healthcare, and infrastructure.

Overview of New Mexico’s Tax System

New Mexico’s tax system is a blend of various tax types, each with its own set of rules and regulations. Understanding the different tax types and how they apply to your specific situation is essential for compliance.

* **Gross Receipts Tax (GRT):** This is a tax on the gross receipts of businesses operating in New Mexico. It’s similar to a sales tax but is levied on a broader range of transactions.

* **Income Tax:** This is a tax on the income of individuals and businesses earned in New Mexico.

* **Property Tax:** This is a tax on the value of real and personal property.

* **Excise Taxes:** These are taxes on specific goods and services, such as gasoline, alcohol, and tobacco.

* **Compensating Tax:** This is a tax on tangible personal property purchased outside of New Mexico but used within the state.

Key Principles of New Mexico’s Tax Laws

Several key principles underpin New Mexico’s tax laws. These principles guide the interpretation and application of the laws and ensure fairness and equity in the tax system.

* **Uniformity:** Tax laws should be applied consistently to all taxpayers in similar situations.

* **Equity:** The tax burden should be distributed fairly among taxpayers based on their ability to pay.

* **Simplicity:** Tax laws should be clear and easy to understand to promote compliance.

* **Efficiency:** The tax system should be designed to minimize administrative costs and maximize revenue collection.

Delving into the Gross Receipts Tax (GRT) in New Mexico

The Gross Receipts Tax (GRT) is a cornerstone of New Mexico’s state taxation and revenue system. It’s a tax on the total gross receipts of businesses operating in the state, regardless of whether they are located within New Mexico or not. Understanding the GRT is crucial for any business operating in the state.

What is the Gross Receipts Tax (GRT)?

The GRT is a tax on the total amount of money a business receives from selling goods or services. It’s similar to a sales tax but is levied on a broader range of transactions. Unlike a sales tax, which is typically collected from the consumer, the GRT is levied directly on the business.

Who is Subject to the GRT?

Generally, any business that engages in business activities in New Mexico is subject to the GRT. This includes:

* Businesses located within New Mexico

* Businesses located outside of New Mexico that sell goods or services to customers in New Mexico

* Businesses that have a physical presence in New Mexico, such as a store, office, or warehouse

GRT Rate and Calculation

The GRT rate varies depending on the location of the business activity. The state GRT rate is currently 5.125%, but local governments can impose additional GRT rates, resulting in a combined rate that can range from 5.125% to over 9%. To calculate the GRT, simply multiply your gross receipts by the applicable GRT rate.

*Example:* If your business has gross receipts of $100,000 and the applicable GRT rate is 7%, your GRT liability would be $7,000 ($100,000 x 0.07).

Common GRT Exemptions and Deductions

While the GRT applies broadly, there are several exemptions and deductions that businesses can claim to reduce their GRT liability. Some common exemptions and deductions include:

* **Sales to Resale:** Sales of goods that will be resold by the purchaser are exempt from the GRT.

* **Sales to Government Entities:** Sales to federal, state, and local government entities are often exempt.

* **Interstate Commerce:** Sales of goods that are shipped out of state are generally exempt.

* **Certain Services:** Some services, such as medical services and educational services, may be exempt.

It’s crucial to consult with a tax professional or the NMTRD to determine which exemptions and deductions apply to your specific situation.

Navigating New Mexico’s Income Tax System

New Mexico’s income tax system applies to both individuals and businesses. Understanding the rules and regulations governing income tax is essential for compliance and effective tax planning.

Individual Income Tax

New Mexico’s individual income tax is based on a progressive tax rate structure. This means that higher income earners pay a higher percentage of their income in taxes. The tax rates and income brackets are subject to change, so it’s essential to stay updated on the latest information.

* **Filing Requirements:** Individuals who meet certain income thresholds are required to file a New Mexico income tax return. The filing deadline is typically April 15th, unless an extension is granted.

* **Deductions and Credits:** New Mexico offers various deductions and credits that can reduce your taxable income. These include deductions for medical expenses, charitable contributions, and retirement contributions, as well as credits for childcare expenses and education expenses.

Corporate Income Tax

New Mexico’s corporate income tax applies to corporations doing business in the state. The corporate income tax rate is a flat rate applied to a corporation’s net income.

* **Nexus:** A corporation must have nexus with New Mexico to be subject to the corporate income tax. Nexus is generally established when a corporation has a physical presence in the state or engages in significant business activities within the state.

* **Apportionment:** Corporations that do business in multiple states must apportion their income to New Mexico based on a formula that considers factors such as sales, property, and payroll.

Pass-Through Entities

Pass-through entities, such as partnerships and S corporations, are not subject to the corporate income tax. Instead, the income from these entities is passed through to the owners, who report it on their individual income tax returns.

Property Tax in New Mexico: An Overview

Property tax is a significant source of revenue for local governments in New Mexico. It’s a tax on the value of real and personal property and is used to fund essential services such as schools, fire protection, and law enforcement.

What is Taxable Property?

Taxable property in New Mexico includes:

* **Real Property:** Land and buildings

* **Personal Property:** Movable property, such as furniture, equipment, and vehicles

Property Valuation and Assessment

The value of property is determined by the county assessor. The assessor uses various methods to determine the fair market value of the property, including comparable sales, cost approach, and income approach.

* **Assessment Ratio:** The assessed value of property is typically a percentage of its fair market value. This percentage is known as the assessment ratio.

Property Tax Rates and Calculation

Property tax rates vary depending on the location of the property. The tax rate is determined by the local taxing authorities, such as the county, municipality, and school district. To calculate your property tax liability, multiply the assessed value of your property by the applicable tax rate.

Property Tax Exemptions

New Mexico offers several property tax exemptions that can reduce your property tax liability. These include exemptions for:

* **Head of Family:** A partial exemption for heads of households.

* **Veterans:** A partial exemption for veterans.

* **Senior Citizens:** A partial exemption for senior citizens.

Excise Taxes in New Mexico: Specific Goods and Services

Excise taxes are taxes on specific goods and services, such as gasoline, alcohol, and tobacco. These taxes are typically levied on the manufacturer or distributor and are passed on to the consumer in the form of higher prices.

Common Excise Taxes in New Mexico

Some of the most common excise taxes in New Mexico include:

* **Gasoline Tax:** A tax on gasoline sold in the state.

* **Alcohol Tax:** A tax on alcoholic beverages sold in the state.

* **Tobacco Tax:** A tax on tobacco products sold in the state.

Purpose of Excise Taxes

Excise taxes are often used to generate revenue for specific purposes, such as transportation projects or healthcare programs. They can also be used to discourage the consumption of certain goods or services, such as tobacco products.

Compensating Tax: Tax on Out-of-State Purchases

The compensating tax is a tax on tangible personal property purchased outside of New Mexico but used within the state. It’s designed to level the playing field between businesses located in New Mexico and businesses located outside of the state.

When is Compensating Tax Due?

Compensating tax is due when you purchase tangible personal property outside of New Mexico and bring it into the state for use or consumption. The tax rate is the same as the GRT rate in the location where the property is used.

Exemptions from Compensating Tax

There are several exemptions from the compensating tax, including:

* **Property Purchased for Resale:** Property purchased for resale is exempt from the compensating tax.

* **Property Subject to GRT:** Property that is subject to the GRT is exempt from the compensating tax.

Taxation and Revenue Department Online Services

The New Mexico Taxation and Revenue Department offers a wide range of online services to make it easier for taxpayers to comply with their tax obligations. These services include:

* **Online Filing:** You can file many New Mexico tax returns online through the NMTRD’s website.

* **Online Payment:** You can pay your taxes online using a credit card, debit card, or electronic check.

* **Online Account Management:** You can manage your tax accounts online, including viewing your account balance, making payments, and updating your contact information.

* **Online Resources:** The NMTRD’s website provides a wealth of information about New Mexico’s tax laws, including FAQs, publications, and forms.

Expert Tips for Navigating New Mexico State Taxation and Revenue

Navigating New Mexico’s tax system can be challenging, but with the right knowledge and strategies, you can stay compliant and minimize your tax liability. Here are some expert tips to help you:

* **Keep Accurate Records:** Maintaining accurate records of your income, expenses, and assets is essential for tax compliance.

* **Stay Updated on Tax Laws:** New Mexico’s tax laws are subject to change, so it’s essential to stay updated on the latest information.

* **Take Advantage of Deductions and Credits:** New Mexico offers various deductions and credits that can reduce your tax liability. Be sure to take advantage of all the deductions and credits that you are eligible for.

* **Seek Professional Advice:** If you are unsure about any aspect of New Mexico’s tax system, consult with a tax professional.

Q&A: Common Questions about New Mexico State Taxation and Revenue

Here are some frequently asked questions about New Mexico state taxation and revenue:

1. **What is the difference between the GRT and sales tax?** The GRT is levied on the business, while sales tax is levied on the consumer. The GRT also applies to a broader range of transactions than sales tax.

2. **How do I determine the correct GRT rate for my business?** The GRT rate depends on the location of your business activity. You can find the applicable GRT rate on the NMTRD’s website.

3. **What are some common GRT exemptions?** Common GRT exemptions include sales to resale, sales to government entities, and interstate commerce.

4. **How do I file my New Mexico income tax return?** You can file your New Mexico income tax return online through the NMTRD’s website or by mail.

5. **What are some common income tax deductions?** Common income tax deductions include deductions for medical expenses, charitable contributions, and retirement contributions.

6. **How is property tax calculated in New Mexico?** Property tax is calculated by multiplying the assessed value of your property by the applicable tax rate.

7. **What are some common property tax exemptions?** Common property tax exemptions include exemptions for heads of family, veterans, and senior citizens.

8. **What are excise taxes?** Excise taxes are taxes on specific goods and services, such as gasoline, alcohol, and tobacco.

9. **What is compensating tax?** Compensating tax is a tax on tangible personal property purchased outside of New Mexico but used within the state.

10. **Where can I find more information about New Mexico state taxation and revenue?** You can find more information about New Mexico state taxation and revenue on the NMTRD’s website or by consulting with a tax professional.

Conclusion: Mastering New Mexico State Taxation and Revenue

Navigating the complexities of New Mexico state taxation and revenue requires a thorough understanding of the various tax types, regulations, and procedures. This guide has provided you with a comprehensive overview of the key aspects of the system, empowering you to stay compliant and make informed decisions. By staying informed, keeping accurate records, and seeking professional advice when needed, you can effectively manage your tax obligations and contribute to the economic well-being of New Mexico.

We encourage you to explore the New Mexico Taxation and Revenue Department’s website for the most up-to-date information and resources. Share your experiences with navigating New Mexico’s tax system in the comments below – your insights can help others better understand this complex landscape. Consider consulting with a qualified tax professional for personalized guidance tailored to your specific circumstances.