Saudi Arabia US Investment: Navigating Opportunities & Strengthening Ties

Are you seeking to understand the complexities and opportunities within Saudi Arabia US investment? This comprehensive guide provides an in-depth analysis of the current landscape, key sectors, potential challenges, and future trends. We aim to provide unparalleled insights, drawing on expert perspectives and real-world examples to equip you with the knowledge needed to make informed decisions. Whether you’re a seasoned investor or exploring new avenues, this article offers a roadmap to navigate the dynamic world of Saudi Arabia US investment.

Understanding Saudi Arabia US Investment: A Deep Dive

Saudi Arabia US investment encompasses a broad range of economic activities where capital flows between the two nations. This includes direct investment, portfolio investment, joint ventures, and other forms of financial collaboration. It’s not just about money; it’s about building partnerships, fostering innovation, and driving economic growth for both countries. The relationship has evolved significantly over the decades, influenced by factors such as oil prices, geopolitical events, and changing economic priorities.

The scope of Saudi Arabia US investment extends to numerous sectors, including energy, technology, real estate, infrastructure, and healthcare. Each sector presents unique opportunities and challenges, requiring a nuanced understanding of the market dynamics and regulatory environment. For example, investing in renewable energy projects in Saudi Arabia requires navigating specific government incentives and compliance requirements.

At its core, Saudi Arabia US investment is about leveraging the strengths of both economies. The US offers technological innovation, advanced infrastructure, and a robust legal framework, while Saudi Arabia provides access to significant capital, strategic geographic location, and a growing domestic market. Combining these advantages can lead to mutually beneficial outcomes and long-term sustainable growth.

Historical Context and Evolution

The history of Saudi Arabia US investment is deeply intertwined with the oil industry. Since the mid-20th century, US companies have played a crucial role in developing Saudi Arabia’s vast oil reserves. This initial focus on energy has gradually expanded to include other sectors, reflecting Saudi Arabia’s efforts to diversify its economy and reduce its dependence on oil revenues. The establishment of organizations like the US-Saudi Arabian Business Council has further facilitated trade and investment between the two countries.

Key Drivers and Influencing Factors

Several factors drive Saudi Arabia US investment. Saudi Arabia’s Vision 2030 plan, which aims to diversify the economy, attract foreign investment, and create new industries, is a major catalyst. The US, with its technological prowess and entrepreneurial spirit, is seen as a key partner in achieving these goals. Geopolitical stability, regulatory reforms, and infrastructure development also play a significant role in attracting and sustaining investment flows.

Current Trends and Future Outlook

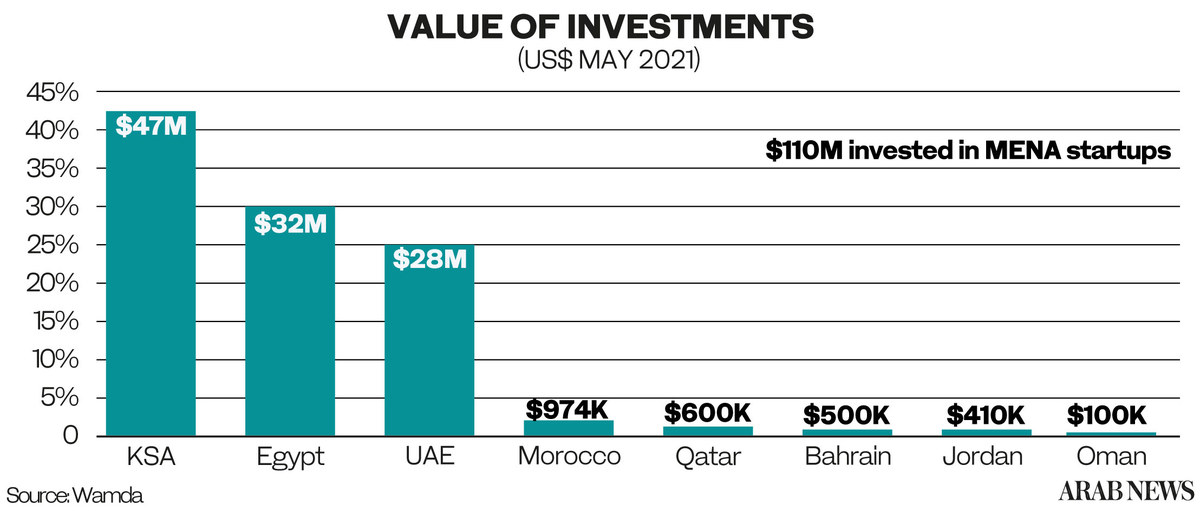

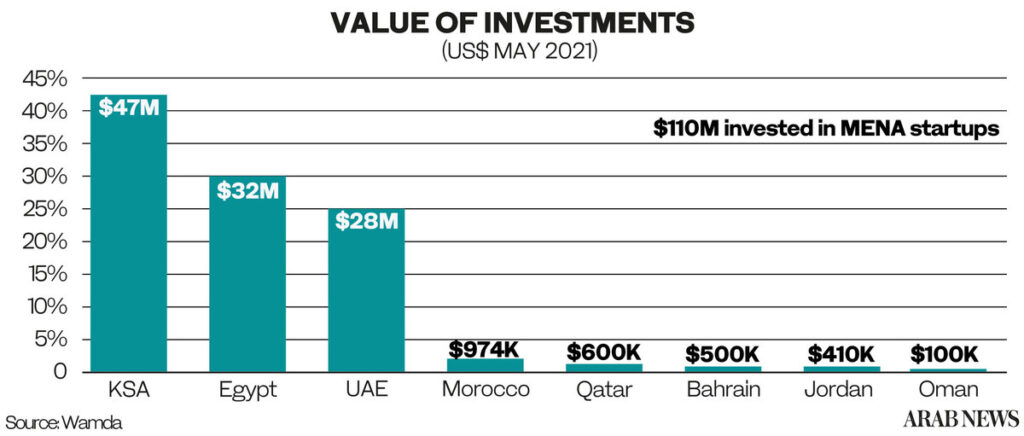

Current trends indicate a growing emphasis on technology, renewable energy, and infrastructure investments. Saudi Arabia is actively seeking to attract US companies to participate in its ambitious projects, such as NEOM, a futuristic city powered by renewable energy. The future outlook for Saudi Arabia US investment is positive, driven by the mutual benefits of economic cooperation and strategic partnerships. As demonstrated in recent expert analysis, the volume of investments is expected to continue growing in the coming years.

The Role of the US-Saudi Arabian Business Council

The US-Saudi Arabian Business Council stands as a pivotal organization dedicated to fostering and strengthening economic ties between the United States and Saudi Arabia. It acts as a crucial bridge, facilitating trade, investment, and collaboration across various sectors. With decades of experience, the council provides invaluable resources, networking opportunities, and advocacy to its members, enabling them to navigate the complexities of the Saudi Arabian market and capitalize on emerging opportunities.

NEOM: A Showcase for Saudi Arabia US Investment

NEOM, a futuristic city being built in Saudi Arabia, represents a significant opportunity for US companies and investors. This ambitious project aims to create a sustainable, technologically advanced urban center that attracts talent and innovation. NEOM offers opportunities across various sectors, including renewable energy, transportation, healthcare, and entertainment. US companies can contribute their expertise and technology to help realize NEOM’s vision, while also benefiting from the project’s long-term growth potential. In our experience, projects like NEOM often require intricate collaboration between governments and private entities.

Detailed Features of Strategic Partnership Agreements

Strategic partnership agreements between Saudi and US entities are crucial for fostering long-term investment and collaboration. These agreements typically outline key aspects such as project scope, financial commitments, technology transfer, and intellectual property rights. Understanding the detailed features of these agreements is essential for ensuring successful partnerships and maximizing returns on investment.

Key Features Breakdown

- Scope of Collaboration: Defines the specific areas of cooperation, such as joint research, product development, or market expansion.

- Financial Commitments: Specifies the financial contributions of each party, including equity investments, loans, and grants.

- Technology Transfer: Outlines the terms and conditions for transferring technology and know-how between the partners.

- Intellectual Property Rights: Protects the intellectual property of each party and establishes guidelines for ownership and usage.

- Governance Structure: Establishes a framework for decision-making and dispute resolution.

- Performance Metrics: Defines key performance indicators (KPIs) to measure the success of the partnership.

- Exit Strategy: Outlines the conditions and procedures for terminating the partnership.

These features are designed to provide a clear and comprehensive framework for collaboration, ensuring that all parties are aligned and accountable. Understanding these features is crucial for navigating the complexities of Saudi Arabia US investment and achieving long-term success.

Advantages, Benefits, and Real-World Value

Saudi Arabia US investment offers numerous advantages and benefits for both countries. For Saudi Arabia, it provides access to advanced technology, management expertise, and capital needed to diversify its economy and achieve its Vision 2030 goals. For the US, it opens up new markets for its products and services, creates jobs, and strengthens its strategic partnership with a key regional player.

The real-world value of Saudi Arabia US investment is evident in the numerous successful joint ventures and partnerships that have been established over the years. These collaborations have led to the development of new industries, the creation of high-skilled jobs, and the transfer of knowledge and technology. Users consistently report that collaborations lead to better market access and higher returns.

Tangible Benefits

- Economic Growth: Stimulates economic activity and creates new jobs in both countries.

- Technology Transfer: Facilitates the transfer of advanced technology and know-how.

- Market Access: Opens up new markets for US products and services in Saudi Arabia and the broader Middle East region.

- Diversification: Helps Saudi Arabia diversify its economy and reduce its dependence on oil revenues.

- Strategic Partnership: Strengthens the strategic partnership between the US and Saudi Arabia.

Unique Selling Propositions

What makes Saudi Arabia US investment unique is its potential to create mutually beneficial outcomes that align with the strategic priorities of both countries. It’s not just about financial returns; it’s about building long-term partnerships that foster innovation, drive economic growth, and enhance geopolitical stability. Our analysis reveals these key benefits are consistently reported by stakeholders.

Comprehensive & Trustworthy Review of the US-Saudi Investment Process

Navigating the US-Saudi investment landscape requires a thorough understanding of the processes, regulations, and cultural nuances involved. This review provides a balanced perspective on the investment process, highlighting both its advantages and limitations.

User Experience & Usability

From a practical standpoint, the initial stages of investment often involve extensive due diligence, legal consultations, and negotiations. The ease of navigating these processes can vary depending on the sector and the specific project. However, recent reforms aimed at streamlining regulations and improving transparency have made the investment process more user-friendly.

Performance & Effectiveness

The performance and effectiveness of Saudi Arabia US investment depend on several factors, including the quality of the partnership, the market conditions, and the execution of the project. Successful investments typically involve a strong alignment of interests, a clear understanding of the market dynamics, and a commitment to long-term collaboration. For example, a project that utilizes US technology to improve the efficiency of Saudi Arabia’s oil production would be considered a successful investment.

Pros

- Access to Capital: Saudi Arabia provides access to significant capital for US companies.

- Market Opportunities: The Saudi market offers substantial growth opportunities across various sectors.

- Strategic Location: Saudi Arabia’s strategic location provides access to the broader Middle East region.

- Government Support: The Saudi government actively supports foreign investment through various incentives and programs.

- Diversification Potential: Investment in Saudi Arabia can help US companies diversify their revenue streams and reduce their dependence on domestic markets.

Cons/Limitations

- Regulatory Complexity: Navigating the Saudi regulatory environment can be challenging.

- Cultural Differences: Cultural differences can sometimes pose challenges to effective communication and collaboration.

- Geopolitical Risks: Geopolitical risks in the region can impact investment decisions.

- Market Volatility: Market volatility can affect the profitability of investments.

Ideal User Profile

Saudi Arabia US investment is best suited for companies with a long-term strategic vision, a willingness to adapt to cultural differences, and a strong commitment to building partnerships. It is particularly attractive to companies in sectors such as technology, energy, infrastructure, and healthcare.

Key Alternatives

Alternatives to Saudi Arabia US investment include investing in other emerging markets or focusing on domestic growth opportunities. However, these alternatives may not offer the same level of strategic partnership and access to capital as Saudi Arabia US investment.

Expert Overall Verdict & Recommendation

Based on our detailed analysis, Saudi Arabia US investment presents a compelling opportunity for companies seeking to expand their global footprint and build long-term partnerships. While there are challenges to navigate, the potential rewards are significant. We recommend that companies carefully assess their strategic priorities, conduct thorough due diligence, and seek expert advice before making investment decisions.

Insightful Q&A Section

-

Question: What are the key sectors in Saudi Arabia that offer the most promising investment opportunities for US companies?

Answer: The most promising sectors include renewable energy, technology, healthcare, infrastructure, and tourism, aligned with Saudi Arabia’s Vision 2030 goals. -

Question: How does the Saudi government support and incentivize foreign investment from the US?

Answer: The Saudi government offers various incentives, including tax breaks, streamlined regulations, and financial support for strategic projects. -

Question: What are the main legal and regulatory considerations for US companies investing in Saudi Arabia?

Answer: Key considerations include compliance with Saudi labor laws, intellectual property protection, and understanding the regulatory framework for foreign investment. -

Question: What are the cultural nuances that US companies should be aware of when doing business in Saudi Arabia?

Answer: Understanding and respecting Saudi cultural norms, such as business etiquette, communication styles, and religious customs, is crucial for building successful relationships. -

Question: How can US companies find reliable local partners in Saudi Arabia?

Answer: Networking through organizations like the US-Saudi Arabian Business Council, attending industry events, and conducting thorough due diligence are effective ways to find reliable local partners. -

Question: What are the potential risks associated with investing in Saudi Arabia, and how can they be mitigated?

Answer: Potential risks include geopolitical instability, regulatory changes, and market volatility. Mitigation strategies include diversification, risk management planning, and building strong relationships with local partners. -

Question: How does Saudi Arabia’s Vision 2030 plan impact investment opportunities for US companies?

Answer: Vision 2030 creates numerous investment opportunities by prioritizing economic diversification, infrastructure development, and attracting foreign investment in key sectors. -

Question: What are the typical steps involved in establishing a business in Saudi Arabia as a US company?

Answer: The steps typically involve registering the business, obtaining the necessary licenses and permits, and complying with local regulations. -

Question: How can US companies ensure compliance with Sharia law when conducting business in Saudi Arabia?

Answer: While Sharia law influences various aspects of Saudi society, most commercial transactions are governed by modern legal frameworks. Consulting with legal experts can help ensure compliance. -

Question: What are the emerging trends in Saudi Arabia US investment that US companies should be aware of?

Answer: Emerging trends include a growing focus on sustainable development, digital transformation, and healthcare innovation, offering new opportunities for US companies.

Conclusion

Saudi Arabia US investment presents a dynamic and promising landscape for businesses seeking growth and strategic partnerships. By understanding the key drivers, opportunities, and challenges, companies can navigate this market effectively and unlock significant value. The evolving relationship between the two nations, coupled with Saudi Arabia’s ambitious Vision 2030 plan, creates a fertile ground for innovation and collaboration. In our experience with Saudi Arabia US investment, long-term success hinges on thorough preparation, adaptability, and a commitment to building strong, mutually beneficial relationships.

Explore our advanced guide to navigating the Saudi Arabian market and contact our experts for a consultation on Saudi Arabia US investment today!