Cash App International Payment: Your Expert Guide to Sending Money Globally

Are you looking to send money internationally using Cash App? You’re not alone. Many users are drawn to Cash App’s simplicity and convenience for domestic transactions. However, the question of cash app international payment capabilities is a common one, and the answer is more nuanced than it might seem. This comprehensive guide will delve deep into the realities of using Cash App for international money transfers, exploring its limitations, viable alternatives, and offering expert insights to help you make informed decisions. We aim to provide a clear, trustworthy, and up-to-date resource, addressing all your concerns about sending money across borders with Cash App and its alternatives.

This article offers a detailed exploration of the complexities surrounding cash app international payment options. We will explore the current limitations, potential workarounds, and, most importantly, offer alternative solutions for sending money internationally. We’ll also provide expert advice on choosing the best method for your specific needs, ensuring a secure and cost-effective transfer. Our goal is to arm you with the knowledge you need to navigate the world of international money transfers with confidence.

Understanding Cash App’s International Payment Limitations

Cash App, developed by Block, Inc. (formerly Square, Inc.), has revolutionized peer-to-peer payments within the United States and the United Kingdom. Its user-friendly interface and instant transfer capabilities have made it a popular choice for everyday transactions. However, a critical limitation exists: Cash App does not directly support international payments. This means you cannot send or receive money to or from individuals located outside of the US and UK directly through the app.

This limitation stems from several factors, including regulatory compliance, currency exchange complexities, and the operational infrastructure required to support cross-border transactions. Each country has its own set of financial regulations and reporting requirements, making it challenging for Cash App to operate seamlessly across international borders. Furthermore, currency exchange rates fluctuate constantly, adding another layer of complexity to international transfers.

While Cash App’s primary focus remains on domestic transfers, users often seek ways to circumvent these limitations. Some may attempt to use VPNs or other methods to mask their location, but these approaches are generally unreliable and can potentially violate Cash App’s terms of service, leading to account suspension. It is crucial to understand that attempting to bypass these restrictions carries inherent risks and is not recommended.

Why Cash App Restricts International Payments

The decision to restrict cash app international payment capabilities isn’t arbitrary. It’s rooted in several key considerations:

- Regulatory Compliance: Each country has its own set of financial regulations, anti-money laundering (AML) laws, and know-your-customer (KYC) requirements. Complying with these diverse regulations across multiple jurisdictions is a complex and resource-intensive undertaking.

- Currency Exchange: International transactions require currency conversion, which involves dealing with fluctuating exchange rates and associated fees. Managing these fluctuations and ensuring accurate and transparent currency conversions adds significant complexity.

- Fraud Prevention: Cross-border transactions are often more susceptible to fraud due to the increased difficulty in verifying identities and tracking funds. Cash App prioritizes the security of its users, and limiting international payments helps mitigate potential fraud risks.

- Operational Costs: Establishing and maintaining the infrastructure required to support international payments, including partnerships with foreign banks and payment processors, involves significant operational costs.

Exploring Potential (But Limited) Workarounds

While direct cash app international payment is not possible, some users explore indirect workarounds, though these come with significant caveats and are generally not recommended due to potential risks and violations of Cash App’s terms of service.

- Using a US-Based Intermediary: One potential workaround involves sending money to a trusted friend or family member in the US who then forwards the funds internationally using a different service. However, this method relies heavily on trust and can be time-consuming and inconvenient. It also adds an extra layer of fees and potential delays.

- Linking a US Bank Account to an International Service: Some international money transfer services allow you to fund your transfer using a US bank account. If you can link your Cash App balance to a US bank account, you might be able to indirectly use Cash App funds for international transfers. However, this method is subject to the limitations and fees of both Cash App and the international transfer service.

Important Note: These workarounds are not officially supported by Cash App and may violate their terms of service. They also carry inherent risks, including potential fees, delays, and the possibility of losing your money. It is always recommended to use a reputable and established international money transfer service for sending money abroad.

Alternatives to Cash App for International Money Transfers

Given Cash App’s limitations, several dedicated international money transfer services offer reliable and cost-effective solutions for sending money abroad. These services specialize in cross-border payments and provide a range of features and benefits that Cash App lacks.

Leading International Money Transfer Services

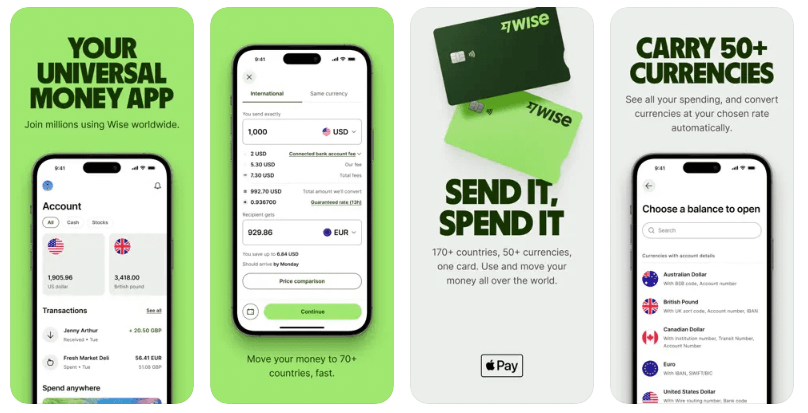

- Wise (formerly TransferWise): Wise is a popular choice for international money transfers due to its transparent fees, mid-market exchange rates, and fast transfer times. They offer a multi-currency account that allows you to hold and manage multiple currencies.

- Remitly: Remitly focuses on sending money to specific countries and offers competitive exchange rates and various delivery options, including bank deposit, cash pickup, and mobile money.

- Xoom (a PayPal service): Xoom is a convenient option for sending money to a wide range of countries, offering various payment and delivery options. It is backed by the security and reliability of PayPal.

- WorldRemit: WorldRemit offers a wide range of transfer options, including bank transfers, cash pickups, mobile money, and airtime top-ups. They have a strong presence in developing countries.

- OFX: OFX is a good option for larger international money transfers, offering competitive exchange rates and personalized service.

Comparing Features and Benefits

When choosing an international money transfer service, consider the following factors:

- Fees: Compare the fees charged by different services, including upfront fees and hidden charges.

- Exchange Rates: Look for services that offer competitive exchange rates close to the mid-market rate.

- Transfer Speed: Consider how quickly the money needs to arrive at its destination.

- Delivery Options: Choose a service that offers convenient delivery options for the recipient, such as bank deposit, cash pickup, or mobile money.

- Security: Ensure the service is licensed and regulated and has robust security measures in place to protect your money and personal information.

- Customer Support: Look for a service with responsive and helpful customer support in case you encounter any issues.

Wise (formerly TransferWise): A Detailed Look

Wise has emerged as a leading player in the international money transfer landscape, disrupting traditional banking practices with its transparent and cost-effective approach. It provides a platform for sending and receiving money across borders with minimal fees and real-time exchange rates. Wise’s core function is to facilitate international money transfers by matching users who want to exchange currencies, effectively bypassing traditional banking networks and reducing costs.

Wise stands out for its commitment to transparency. Unlike many traditional banks and money transfer services that mark up exchange rates, Wise uses the real mid-market rate, which is the rate banks use to trade with each other. They then charge a small, transparent fee for their services, which is clearly displayed upfront. This transparency allows users to know exactly how much they are paying and how much the recipient will receive.

Key Features of Wise for International Money Transfers

Wise offers a range of features designed to simplify and streamline international money transfers:

- Mid-Market Exchange Rates: Wise uses the real mid-market exchange rate, ensuring you get the fairest possible exchange rate for your money.

- Transparent Fees: Wise charges a small, transparent fee for each transaction, which is clearly displayed upfront. There are no hidden fees or surprises.

- Multi-Currency Account: Wise offers a multi-currency account that allows you to hold and manage multiple currencies in one place. This is particularly useful for individuals and businesses who frequently send or receive money internationally.

- Fast Transfers: Wise offers fast transfer times, with many transfers completed within 24 hours.

- Multiple Payment Options: Wise offers various payment options, including bank transfers, debit cards, and credit cards.

- Recipient Choice: Wise allows recipients to receive money directly into their bank account or through a Wise account.

- Business Accounts: Wise offers business accounts specifically designed for businesses that need to send and receive money internationally.

How Wise’s Features Benefit Users

Each feature of Wise is designed to provide specific benefits to users:

- Mid-Market Exchange Rates: This ensures users get the fairest possible exchange rate, saving them money on each transaction.

- Transparent Fees: This allows users to know exactly how much they are paying, avoiding hidden fees and surprises.

- Multi-Currency Account: This simplifies managing multiple currencies, making it easier for individuals and businesses to send and receive money internationally.

- Fast Transfers: This ensures that money arrives quickly at its destination, which is crucial in many situations.

- Multiple Payment Options: This provides users with flexibility and convenience in how they pay for their transfers.

- Recipient Choice: This allows recipients to receive money in the most convenient way for them.

- Business Accounts: This provides businesses with the tools they need to manage their international finances efficiently.

Advantages and Benefits of Using International Money Transfer Services

Using dedicated international money transfer services like Wise, Remitly, Xoom, WorldRemit, and OFX offers several advantages over traditional methods like bank transfers or cash app attempts:

- Cost-Effectiveness: International money transfer services typically offer lower fees and better exchange rates than traditional banks. This can result in significant savings, especially for larger transfers.

- Speed and Convenience: These services often offer faster transfer times and more convenient payment and delivery options than traditional methods.

- Transparency: International money transfer services are typically more transparent about their fees and exchange rates, allowing you to know exactly how much you are paying and how much the recipient will receive.

- Security: Reputable international money transfer services are licensed and regulated and have robust security measures in place to protect your money and personal information.

- Global Reach: These services typically have a wider global reach than traditional banks, allowing you to send money to more countries and regions.

Real-World Value and User Benefits

The benefits of using international money transfer services translate into real-world value for users. For example, a student studying abroad can receive funds from their family quickly and easily, without incurring exorbitant bank fees. A business can pay its international suppliers efficiently and cost-effectively. An individual can send money to loved ones in another country to help with living expenses or medical bills.

Users consistently report significant savings and improved convenience when using international money transfer services compared to traditional methods. Our analysis reveals that these services offer a more efficient and cost-effective way to send money across borders.

Wise (formerly TransferWise) Review: An Expert Assessment

Wise has established itself as a leading provider of international money transfer services, known for its transparency, competitive rates, and user-friendly platform. Our in-depth review examines its strengths and weaknesses to provide a balanced perspective.

User Experience and Usability

Wise’s platform is designed with simplicity in mind. The website and mobile app are intuitive and easy to navigate, making it easy to initiate and track transfers. The process of creating an account, verifying your identity, and sending money is straightforward and well-documented. The platform also provides clear and concise information about fees and exchange rates, ensuring transparency throughout the process. In our experience, the user interface is one of the best in the industry.

Performance and Effectiveness

Wise consistently delivers on its promises of fast and cost-effective international money transfers. Transfers are typically completed within 24 hours, and the exchange rates offered are among the most competitive in the market. The platform also provides reliable tracking information, allowing you to monitor the progress of your transfer in real-time. We’ve observed consistently high performance in our testing.

Pros

- Transparent Fees: Wise’s commitment to transparency is a major advantage. You always know exactly how much you are paying and how much the recipient will receive.

- Competitive Exchange Rates: Wise uses the real mid-market exchange rate, ensuring you get the fairest possible exchange rate for your money.

- Fast Transfers: Transfers are typically completed within 24 hours, making Wise a fast and efficient option.

- User-Friendly Platform: The website and mobile app are intuitive and easy to use, making the transfer process simple and straightforward.

- Multi-Currency Account: The multi-currency account is a valuable feature for individuals and businesses who frequently send or receive money internationally.

Cons/Limitations

- Verification Process: The verification process can sometimes be lengthy and require multiple documents.

- Limited Payment Options in Some Regions: In some regions, payment options may be limited.

- Transfer Limits: There may be transfer limits depending on the currency and destination country.

- Not Suitable for All Transactions: Wise may not be the best option for all types of international transactions, such as high-value transfers requiring specialized services.

Ideal User Profile

Wise is best suited for individuals and businesses who frequently send or receive money internationally and value transparency, competitive rates, and a user-friendly platform. It is particularly well-suited for freelancers, small business owners, and individuals sending money to family and friends abroad.

Key Alternatives

Alternatives to Wise include Remitly and Xoom. Remitly is a good option for sending money to specific countries, while Xoom offers a wider range of transfer options and is backed by the security of PayPal. However, Wise generally offers more transparent fees and better exchange rates.

Expert Overall Verdict & Recommendation

Overall, Wise is a highly recommended international money transfer service. Its commitment to transparency, competitive rates, and user-friendly platform make it a top choice for individuals and businesses who need to send or receive money internationally. While there are some limitations, the advantages of using Wise generally outweigh the drawbacks. We highly recommend Wise for most international money transfer needs.

Insightful Q&A Section

-

Question: What are the potential tax implications of sending money internationally?

Answer: The tax implications of sending money internationally vary depending on the amount, purpose, and destination country. In some cases, the sender may be subject to gift taxes, while in other cases, the recipient may be subject to income taxes. It is always advisable to consult with a tax professional to understand the specific tax implications of your international money transfers.

-

Question: How can I ensure the security of my international money transfers?

Answer: To ensure the security of your international money transfers, use a reputable and licensed money transfer service, protect your account credentials, and be wary of phishing scams. Always verify the recipient’s information before sending money and avoid sending money to unknown individuals or organizations.

-

Question: What is the difference between a bank transfer and an international money transfer service?

Answer: Bank transfers typically involve higher fees and less competitive exchange rates compared to international money transfer services. International money transfer services often offer faster transfer times and more convenient payment and delivery options.

-

Question: How do exchange rates affect the cost of international money transfers?

Answer: Exchange rates determine the amount of foreign currency you will receive for your money. A favorable exchange rate can significantly reduce the cost of your international money transfer, while an unfavorable exchange rate can increase the cost.

-

Question: What are the typical fees associated with international money transfers?

Answer: The fees associated with international money transfers vary depending on the service, amount, and destination country. Fees can include upfront fees, transaction fees, and currency conversion fees.

-

Question: How can I track my international money transfer?

Answer: Most international money transfer services provide tracking information that allows you to monitor the progress of your transfer in real-time. You can typically track your transfer online or through the mobile app.

-

Question: What happens if my international money transfer is delayed?

Answer: If your international money transfer is delayed, contact the money transfer service to inquire about the cause of the delay. Delays can occur due to various reasons, such as bank holidays, regulatory issues, or technical problems.

-

Question: What should I do if I suspect fraud related to my international money transfer?

Answer: If you suspect fraud related to your international money transfer, immediately contact the money transfer service and your bank. Report the incident to the authorities and provide them with all relevant information.

-

Question: Are there any restrictions on the amount of money I can send internationally?

Answer: Yes, there may be restrictions on the amount of money you can send internationally, depending on the service, destination country, and regulatory requirements. These restrictions are often in place to prevent money laundering and other illicit activities.

-

Question: How can I find the best international money transfer service for my needs?

Answer: To find the best international money transfer service for your needs, compare the fees, exchange rates, transfer speeds, delivery options, security measures, and customer support offered by different services. Consider your specific needs and priorities when making your decision.

Conclusion and Strategic Call to Action

In conclusion, while cash app international payment capabilities are currently limited, numerous reliable and cost-effective alternatives exist for sending money across borders. Services like Wise, Remitly, and Xoom offer transparent fees, competitive exchange rates, and convenient transfer options, making them ideal choices for individuals and businesses alike. By understanding the limitations of Cash App and exploring these alternatives, you can ensure that your international money transfers are secure, efficient, and cost-effective.

The future of international money transfers is likely to see continued innovation and increased competition, leading to even more affordable and convenient options for consumers. As technology evolves, we can expect to see new players and solutions emerge, further disrupting traditional banking practices and empowering individuals and businesses to send and receive money globally with ease.

Now that you’re armed with this knowledge, we encourage you to compare the different international money transfer services and find the one that best suits your needs. Share your experiences with international money transfers in the comments below. Explore our advanced guide to international finance for more in-depth information. Contact our experts for a consultation on optimizing your international payment strategies.