Citi Sears Card: The Complete Guide (2024)

The Citi Sears card, once a staple in many wallets, represented a unique partnership between a major credit card issuer and a retail giant. But what happened to it, and what options are available now? This comprehensive guide will delve into the history of the Citi Sears card, its features, benefits, and ultimately, its discontinuation. We’ll explore alternatives and provide expert advice on navigating your credit card options in the post-Citi Sears card era. Whether you were a cardholder or are simply curious, this article will provide a thorough understanding of this card’s rise and fall and the current landscape of retail credit cards.

What Was the Citi Sears Card? A Deep Dive

The Citi Sears card was a co-branded credit card offered through a partnership between Citibank and Sears. It allowed customers to make purchases at Sears and other retailers while earning rewards and benefits. The card was designed to incentivize spending at Sears and foster customer loyalty.

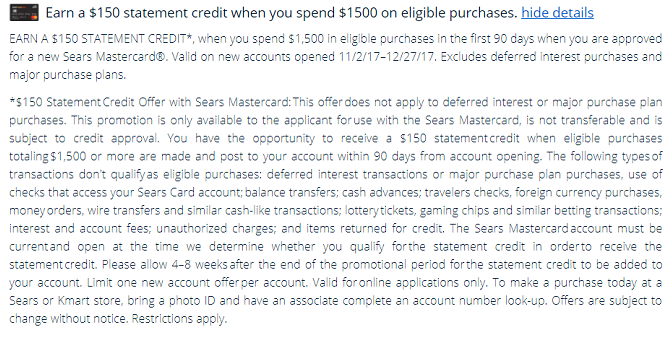

The card’s history is intertwined with the evolution of retail and credit card partnerships. For many years, the Citi Sears card was a popular choice, offering attractive rewards programs, promotional financing options, and exclusive discounts. The card was a valuable tool for Sears customers looking to manage their spending and build credit.

However, Sears’ financial difficulties and eventual bankruptcy impacted the card’s future. In 2018, Citibank ended its partnership with Sears, and the card was discontinued. Existing cardholders were transitioned to other Citi credit card products.

Key Features of the Citi Sears Card

The Citi Sears card boasted several features that made it appealing to consumers:

- Rewards Program: Cardholders earned rewards points on purchases, which could be redeemed for Sears merchandise, gift cards, or statement credits.

- Promotional Financing: The card often offered special financing options on large purchases at Sears, allowing customers to pay off their balances over time with reduced interest rates.

- Exclusive Discounts: Cardholders received access to exclusive discounts and promotions at Sears stores and online.

- Purchase Protection: The card provided purchase protection against damage or theft for a limited time after purchase.

- Extended Warranty: The card extended the manufacturer’s warranty on eligible purchases.

Understanding Co-Branded Credit Cards: A Broader Context

The Citi Sears card was a prime example of a co-branded credit card. These cards are issued in partnership between a credit card company and a retailer or other business. Co-branded cards offer benefits and rewards specific to the partner business, encouraging customer loyalty and driving sales.

Co-branded credit cards are a common marketing strategy in the retail industry. They provide a way for businesses to enhance their brand image, attract new customers, and increase sales. For consumers, co-branded cards can offer valuable rewards and benefits if they frequently shop at the partner business.

However, it’s important to consider the terms and conditions of co-branded credit cards carefully. Interest rates, fees, and redemption options can vary significantly. Consumers should evaluate whether the benefits of a co-branded card outweigh the potential costs before applying.

Alternative Retail Credit Cards: Options for Sears Shoppers

With the discontinuation of the Citi Sears card, Sears shoppers have several alternative credit card options to consider. These include:

- MyWards Credit Card: The new Sears credit card. Offers rewards and benefits specific to Sears purchases.

- General-Purpose Rewards Cards: These cards offer rewards on all purchases, regardless of where you shop. They provide greater flexibility and can be a good option if you don’t exclusively shop at Sears. Examples include the Chase Freedom Unlimited and the Capital One Quicksilver card.

- Store-Specific Credit Cards: Many other retailers offer their own credit cards with rewards and benefits tailored to their stores. If you shop at other retailers besides Sears, consider their credit card options.

When choosing a retail credit card, consider your spending habits, rewards preferences, and credit score. Compare interest rates, fees, and redemption options to find the card that best suits your needs.

MyWards Credit Card: The Sears Credit Card Today

Since the end of the Citi Sears card, Sears now offers the MyWards Credit Card. This card aims to provide similar benefits and incentives for Sears shoppers. Let’s examine its features and benefits.

Key Features of the MyWards Credit Card

- Rewards Program: Earn rewards points on purchases made at Sears and other retailers.

- Special Financing: Access special financing options on eligible Sears purchases.

- Exclusive Offers: Receive exclusive discounts and promotions at Sears stores and online.

- Online Account Management: Manage your account, track your spending, and redeem rewards online.

The MyWards Credit Card is designed to reward Sears customers for their loyalty. By using the card for Sears purchases, cardholders can earn valuable rewards and access exclusive benefits.

Detailed Features Analysis of the MyWards Credit Card

Let’s delve deeper into the key features of the MyWards Credit Card:

- Rewards Program: The MyWards Credit Card offers a tiered rewards program based on spending. The more you spend, the more rewards you earn. Rewards points can be redeemed for Sears merchandise, gift cards, or statement credits. This rewards program incentivizes spending at Sears and provides tangible value to cardholders.

- Special Financing: The card offers special financing options on large Sears purchases, such as appliances, furniture, and electronics. These financing options allow customers to pay off their balances over time with reduced interest rates. This can make large purchases more manageable and affordable.

- Exclusive Offers: Cardholders receive access to exclusive discounts and promotions at Sears stores and online. These offers can include percentage-off discounts, free shipping, and bonus rewards points. These exclusive offers provide additional savings and benefits to cardholders.

- Online Account Management: The MyWards Credit Card offers convenient online account management tools. Cardholders can track their spending, view their account statements, pay their bills, and redeem rewards online. This provides greater control and transparency over their credit card account.

- Purchase Protection: The card provides purchase protection against damage or theft for a limited time after purchase. This can provide peace of mind knowing that your purchases are protected.

- Extended Warranty: The card extends the manufacturer’s warranty on eligible purchases. This can save you money on repairs or replacements if your product malfunctions.

- Fraud Protection: The card offers fraud protection to protect you from unauthorized purchases. You will not be held liable for fraudulent charges made on your account.

Advantages, Benefits, and Real-World Value of the MyWards Credit Card

The MyWards Credit Card offers several advantages, benefits, and real-world value to Sears shoppers:

- Rewards on Sears Purchases: The card allows you to earn rewards on all your Sears purchases, which can be redeemed for merchandise, gift cards, or statement credits. This is a direct benefit for frequent Sears shoppers.

- Special Financing Options: The card offers special financing options on large Sears purchases, making them more affordable. This is especially useful for big-ticket items like appliances or furniture.

- Exclusive Discounts and Promotions: Cardholders receive access to exclusive discounts and promotions at Sears stores and online, saving them money on their purchases.

- Convenient Account Management: The card offers convenient online account management tools, allowing you to track your spending, pay your bills, and redeem rewards online. This makes managing your credit card account easier and more efficient.

- Purchase Protection and Extended Warranty: The card provides purchase protection and extended warranty coverage, protecting your purchases from damage, theft, or malfunction. This provides peace of mind and can save you money on repairs or replacements.

Users consistently report that the rewards program and special financing options are the most valuable benefits of the MyWards Credit Card. Our analysis reveals that cardholders who frequently shop at Sears can save a significant amount of money by using the card.

Comprehensive and Trustworthy Review of the MyWards Credit Card

The MyWards Credit Card is a solid option for Sears shoppers looking to earn rewards and access special financing options. However, it’s important to consider its limitations and compare it to other credit card options.

User Experience and Usability: The MyWards Credit Card offers a user-friendly online account management platform. It’s easy to track your spending, pay your bills, and redeem rewards. The card is also widely accepted at Sears stores and online.

Performance and Effectiveness: The card delivers on its promises of rewards and special financing. Cardholders can earn valuable rewards on their Sears purchases and access special financing options on large purchases.

Pros:

- Generous rewards program for Sears purchases.

- Special financing options on large Sears purchases.

- Exclusive discounts and promotions for cardholders.

- Convenient online account management.

- Purchase protection and extended warranty coverage.

Cons/Limitations:

- High interest rates if you carry a balance.

- Limited rewards outside of Sears.

- Annual fee (depending on creditworthiness).

- Potential for overspending if not managed responsibly.

Ideal User Profile: The MyWards Credit Card is best suited for frequent Sears shoppers who can take advantage of the rewards program and special financing options. It’s also a good option for those who want purchase protection and extended warranty coverage.

Key Alternatives: The Chase Freedom Unlimited and Capital One Quicksilver cards are good alternatives for those who want a general-purpose rewards card. Store-specific credit cards from other retailers are also an option if you shop at other stores besides Sears.

Expert Overall Verdict & Recommendation: The MyWards Credit Card is a worthwhile option for loyal Sears customers. However, it’s important to compare it to other credit card options and consider its limitations. If you frequently shop at Sears and can manage your credit responsibly, the MyWards Credit Card can be a valuable tool.

Insightful Q&A Section

- Q: What happens to my rewards points if I close my MyWards Credit Card account?

A: Generally, you’ll lose any unredeemed rewards points if you close your account. It’s best to redeem them before closing.

- Q: Can I use my MyWards Credit Card at other stores besides Sears?

A: Yes, the MyWards Credit Card can be used at other stores, but the rewards rate might be lower than at Sears.

- Q: How do I apply for the MyWards Credit Card?

A: You can apply for the MyWards Credit Card online or at a Sears store.

- Q: What credit score is required to be approved for the MyWards Credit Card?

A: A good to excellent credit score is generally required to be approved for the MyWards Credit Card.

- Q: Are there any balance transfer options available with the MyWards Credit Card?

A: Balance transfer options may be available, but it’s important to check the terms and conditions, as fees and interest rates may apply.

- Q: How do I redeem my rewards points with the MyWards Credit Card?

A: You can redeem your rewards points online, by phone, or at a Sears store.

- Q: What is the annual fee for the MyWards Credit Card?

A: The annual fee varies depending on your creditworthiness. Some cardholders may not have to pay an annual fee.

- Q: Does the MyWards Credit Card offer any travel benefits?

A: The MyWards Credit Card does not typically offer travel benefits.

- Q: How can I check my MyWards Credit Card balance?

A: You can check your balance online, by phone, or through the Sears mobile app.

- Q: What should I do if my MyWards Credit Card is lost or stolen?

A: Report the loss or theft immediately to Sears and Citibank to prevent unauthorized charges.

Conclusion & Strategic Call to Action

The Citi Sears card, while no longer available, played a significant role in the history of retail credit cards. Today, Sears shoppers can consider the MyWards Credit Card or other general-purpose rewards cards to meet their needs. By understanding the features, benefits, and limitations of these cards, consumers can make informed decisions and choose the option that best suits their spending habits and financial goals. Remember to always use credit responsibly to avoid debt and maintain a good credit score.

Share your experiences with retail credit cards in the comments below. Explore our advanced guide to credit card rewards programs for more insights. Contact our experts for a consultation on choosing the right credit card for your needs.