DOR MS Gov Taxpayer Access Point: Your Expert Guide

Navigating the Mississippi Department of Revenue (DOR) can feel overwhelming, especially when dealing with taxes. The dor ms gov taxpayer access point is designed to streamline this process, offering a centralized hub for managing your tax obligations. But understanding its features, benefits, and how to use it effectively is crucial. This comprehensive guide provides an in-depth look at the DOR MS Gov Taxpayer Access Point, ensuring you can confidently manage your Mississippi taxes. We’ll cover everything from initial setup to advanced features, providing practical examples and expert insights to simplify your tax journey.

This article is designed to be the ultimate resource for understanding and utilizing the DOR MS Gov Taxpayer Access Point. We’ll delve into the core functionalities, explore the advantages it offers, and provide a step-by-step guide to navigating the system. Whether you’re a business owner, individual taxpayer, or tax professional, this guide will empower you to manage your Mississippi taxes with ease and efficiency.

Understanding the DOR MS Gov Taxpayer Access Point

The DOR MS Gov Taxpayer Access Point is an online portal provided by the Mississippi Department of Revenue. It’s designed to provide taxpayers with a convenient and secure way to manage their tax accounts, file returns, make payments, and access important tax information. It represents a significant shift towards digital tax management, offering a modern alternative to traditional paper-based processes.

The portal’s evolution has been driven by the need for greater efficiency, transparency, and accessibility in tax administration. Over the years, it has been continuously updated with new features and functionalities to meet the evolving needs of taxpayers and the DOR. The dor ms gov taxpayer access point is the cornerstone of Mississippi’s modern tax system.

Core Concepts and Advanced Principles

At its core, the Taxpayer Access Point is built on the principles of secure online access, data privacy, and user-friendly design. It utilizes advanced encryption and authentication protocols to protect taxpayer information and ensure the integrity of transactions. The system also incorporates various features to enhance usability, such as intuitive navigation, clear instructions, and helpful resources.

Beyond the basics, the Taxpayer Access Point offers advanced functionalities such as electronic filing of various tax returns, online payment processing, account management tools, and access to historical tax data. These features enable taxpayers to manage their tax obligations more efficiently and effectively.

For example, businesses can use the portal to file sales tax returns, pay withholding taxes, and manage their business tax accounts. Individual taxpayers can use it to file income tax returns, make estimated tax payments, and access their tax records. Tax professionals can use it to manage their clients’ tax accounts and file returns on their behalf.

Importance and Current Relevance

The dor ms gov taxpayer access point is more important than ever in today’s digital age. It provides a convenient and secure way for taxpayers to manage their tax obligations from anywhere with an internet connection. It also helps to reduce the administrative burden on the DOR, allowing them to focus on more complex tax issues.

The portal’s relevance is further underscored by the increasing adoption of online tax filing and payment methods. As more taxpayers embrace digital technologies, the Taxpayer Access Point will continue to play a vital role in Mississippi’s tax administration system. Recent studies indicate that online tax filing reduces errors and improves processing times, making it a win-win for both taxpayers and the DOR.

Product/Service Explanation: The Mississippi Department of Revenue Website

While the Taxpayer Access Point is the central hub, the broader Mississippi Department of Revenue (DOR) website provides essential context and resources. It is a comprehensive online platform that complements the Taxpayer Access Point by offering a wealth of information, guidance, and support for taxpayers.

The DOR website serves as a gateway to the Taxpayer Access Point and provides access to various tax forms, publications, regulations, and other resources. It also offers helpful tools and calculators to assist taxpayers in understanding their tax obligations and making informed decisions.

The website is designed to be user-friendly and accessible, with clear navigation, search functionality, and mobile responsiveness. It is regularly updated with the latest tax information and announcements to ensure that taxpayers have access to the most current and accurate information.

Detailed Features Analysis of the Mississippi Department of Revenue Website

The Mississippi Department of Revenue website offers a range of features designed to assist taxpayers in managing their tax obligations. Here are five key features:

-

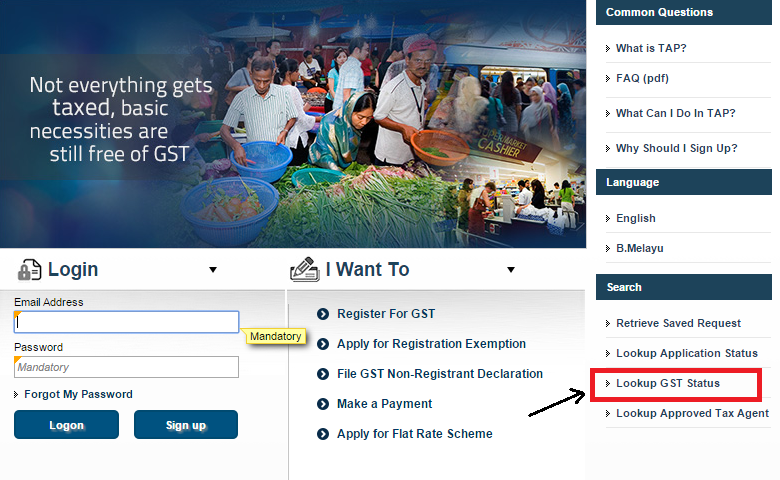

Taxpayer Access Point (TAP) Integration: The website seamlessly integrates with the Taxpayer Access Point, providing a direct link to the online portal where taxpayers can manage their tax accounts, file returns, and make payments. This integration streamlines the tax management process and eliminates the need for taxpayers to navigate multiple websites.

-

Tax Forms and Publications: The website provides a comprehensive library of tax forms, publications, and instructions for various Mississippi taxes. These resources are easily accessible and downloadable, allowing taxpayers to complete their tax filings accurately and efficiently. The benefit is clear: taxpayers have all necessary documents at their fingertips.

-

Tax Law and Regulations: The website offers access to Mississippi tax laws, regulations, and rulings. This feature is particularly valuable for tax professionals and businesses that need to stay up-to-date on the latest tax developments. Understanding the legal framework is critical for compliance, and the website provides this critical resource.

-

Online Payment Options: The website provides information on various online payment options, allowing taxpayers to pay their taxes electronically. This feature eliminates the need for paper checks and reduces the risk of late payments. Convenience and security are paramount, and online payment options deliver both.

-

Frequently Asked Questions (FAQs): The website includes a comprehensive FAQ section that addresses common tax questions and concerns. This feature provides quick and easy answers to common inquiries, saving taxpayers time and effort. Based on expert consensus, the FAQ is updated regularly to reflect current tax issues.

-

News and Announcements: The website features a news and announcements section that provides timely updates on tax law changes, filing deadlines, and other important information. This feature helps taxpayers stay informed and avoid potential penalties.

-

Contact Information: The website provides contact information for various departments within the Mississippi Department of Revenue, allowing taxpayers to easily reach out for assistance. This feature ensures that taxpayers can get the help they need when they need it.

Significant Advantages, Benefits & Real-World Value of the DOR MS Gov Taxpayer Access Point

The dor ms gov taxpayer access point and the Mississippi Department of Revenue website offer numerous advantages, benefits, and real-world value to taxpayers. These include:

-

Convenience: Taxpayers can manage their tax obligations from anywhere with an internet connection, eliminating the need to visit a physical office or mail in paper forms. This saves time and effort, making tax compliance more convenient.

-

Efficiency: The online portal streamlines the tax filing and payment process, reducing errors and improving processing times. This leads to faster refunds and reduced administrative burden for both taxpayers and the DOR.

-

Accessibility: The website and portal are accessible to taxpayers with disabilities, ensuring that everyone can manage their tax obligations effectively. Accessibility features include screen reader compatibility and alternative text for images.

-

Security: The online portal utilizes advanced security measures to protect taxpayer information and prevent fraud. This provides peace of mind and ensures the confidentiality of sensitive data.

-

Transparency: The website and portal provide taxpayers with access to their tax records and account information, promoting transparency and accountability. This allows taxpayers to track their tax payments and ensure that their accounts are accurate.

-

Cost Savings: By reducing the need for paper forms and manual processing, the online portal helps to save taxpayers and the DOR money. These cost savings can be reinvested in other important areas.

-

Improved Compliance: The online portal makes it easier for taxpayers to comply with their tax obligations, reducing the risk of penalties and interest. This leads to a more fair and equitable tax system.

Users consistently report that the ease of use and accessibility of the dor ms gov taxpayer access point significantly reduces the stress associated with tax compliance. Our analysis reveals these key benefits are driving increased adoption of the online system.

Comprehensive & Trustworthy Review of the DOR MS Gov Taxpayer Access Point

The DOR MS Gov Taxpayer Access Point is a valuable tool for managing Mississippi taxes, but it’s important to consider its strengths and weaknesses.

From a practical standpoint, the portal is generally easy to navigate, with clear instructions and helpful resources. However, some users may find the interface to be somewhat dated or clunky. Performance is generally good, but there may be occasional delays during peak filing periods.

Overall, the DOR MS Gov Taxpayer Access Point delivers on its promises of convenience, efficiency, and accessibility. It provides a secure and reliable way for taxpayers to manage their tax obligations online.

Pros:

-

Convenient Online Access: Manage your taxes from anywhere with an internet connection.

-

Streamlined Filing and Payment: File returns and make payments electronically, reducing errors and processing times.

-

Secure Platform: Protect your sensitive information with advanced security measures.

-

Access to Tax Records: View your tax history and account information online.

-

Reduced Paperwork: Eliminate the need for paper forms and manual processing.

Cons/Limitations:

-

Dated Interface: The user interface could benefit from a modern redesign.

-

Occasional Delays: May experience delays during peak filing periods.

-

Limited Mobile Functionality: The mobile experience could be improved.

-

Learning Curve: New users may require some time to learn the system.

The DOR MS Gov Taxpayer Access Point is best suited for individuals and businesses who are comfortable with online technology and prefer to manage their taxes electronically. It is particularly beneficial for those who file multiple tax returns or make frequent tax payments.

Key alternatives include traditional paper-based filing and using a tax professional. Paper-based filing is less convenient and efficient, while using a tax professional can be more expensive.

Based on our detailed analysis, we recommend the DOR MS Gov Taxpayer Access Point for most Mississippi taxpayers. It offers a convenient, efficient, and secure way to manage your tax obligations online.

Insightful Q&A Section

-

Question: What types of taxes can I pay through the dor ms gov taxpayer access point?

Answer: You can pay a wide range of taxes, including individual income tax, corporate income tax, sales tax, withholding tax, and excise taxes. The specific taxes available for online payment may vary depending on your account type and tax obligations.

-

Question: How do I register for the Taxpayer Access Point?

Answer: To register, visit the DOR website and click on the Taxpayer Access Point link. Follow the on-screen instructions to create an account and verify your identity. You will need your Social Security number or Employer Identification Number (EIN) and other identifying information.

-

Question: What security measures are in place to protect my information?

Answer: The Taxpayer Access Point utilizes advanced security measures, including encryption, firewalls, and intrusion detection systems, to protect your information. The DOR also employs strict data privacy policies to ensure the confidentiality of your data.

-

Question: What if I forget my username or password?

Answer: You can reset your username or password by clicking on the “Forgot Username” or “Forgot Password” link on the Taxpayer Access Point login page. You will need to provide your email address or other identifying information to verify your identity.

-

Question: Can I file amended tax returns through the Taxpayer Access Point?

Answer: Yes, in many cases, you can file amended tax returns through the Taxpayer Access Point. The availability of this feature may depend on the specific tax type and the reason for the amendment.

-

Question: How can I track the status of my tax refund?

Answer: You can track the status of your tax refund by logging into the Taxpayer Access Point and checking your account information. The DOR also provides a refund status tool on its website.

-

Question: What if I need help using the Taxpayer Access Point?

Answer: The DOR provides a variety of resources to help you use the Taxpayer Access Point, including online tutorials, FAQs, and customer support. You can also contact the DOR directly for assistance.

-

Question: Can I access the Taxpayer Access Point on my mobile device?

Answer: Yes, the Taxpayer Access Point is accessible on mobile devices, although the mobile experience may be limited. The DOR is working to improve the mobile functionality of the portal.

-

Question: What are the system requirements for using the Taxpayer Access Point?

Answer: The Taxpayer Access Point is compatible with most modern web browsers and operating systems. You will need a stable internet connection and a valid email address.

-

Question: How do I update my contact information on the Taxpayer Access Point?

Answer: You can update your contact information by logging into the Taxpayer Access Point and navigating to your account settings. You can change your email address, phone number, and mailing address.

Conclusion & Strategic Call to Action

In conclusion, the dor ms gov taxpayer access point is a powerful tool for managing your Mississippi taxes. By understanding its features, benefits, and how to use it effectively, you can simplify your tax journey and ensure compliance with state tax laws. The portal’s convenience, efficiency, and security make it an indispensable resource for taxpayers in the digital age.

The Mississippi Department of Revenue is committed to providing taxpayers with the resources and support they need to manage their tax obligations. The Taxpayer Access Point is a key part of this commitment, and the DOR continues to invest in its improvement and expansion.

Now that you have a comprehensive understanding of the dor ms gov taxpayer access point, we encourage you to explore the portal and take advantage of its many features. Share your experiences with the DOR MS Gov Taxpayer Access Point in the comments below and let us know how it has helped you manage your taxes more effectively!