How to Apply for a Suppressor Tax Stamp in Texas: A Comprehensive Guide

Navigating the intricate world of firearms regulations can be daunting, especially when it comes to NFA items like suppressors. If you’re a Texan looking to silence your firearm, understanding how to apply for a suppressor tax stamp in Texas is crucial. This comprehensive guide will walk you through the entire process, from understanding the legal requirements to submitting your application, ensuring you stay on the right side of the law. We’ll delve into the nuances of ATF Form 4, Form 1, trusts, and other essential aspects. Our goal is to provide you with the most up-to-date, accurate, and easy-to-understand information, based on expert knowledge and practical experience.

Understanding NFA Regulations and Suppressors

Suppressors, also known as silencers, are regulated under the National Firearms Act (NFA) of 1934. This federal law imposes strict regulations on the manufacture, transfer, and possession of certain firearms and devices, including suppressors. In Texas, suppressors are legal to own as long as you comply with federal regulations, including obtaining a tax stamp from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

What is a Suppressor Tax Stamp?

A suppressor tax stamp is essentially a permit from the ATF that allows you to legally own a suppressor. It’s called a tax stamp because you must pay a $200 tax to the federal government as part of the application process. This tax is a requirement under the NFA and must be paid for each suppressor you acquire.

Federal vs. State Laws

While federal law regulates suppressors through the NFA, Texas law also plays a role. Texas generally allows the ownership of NFA items that are legal under federal law, provided you comply with all federal requirements. It’s important to note that even if you have a valid tax stamp, you must still adhere to all other applicable state and local laws regarding firearms.

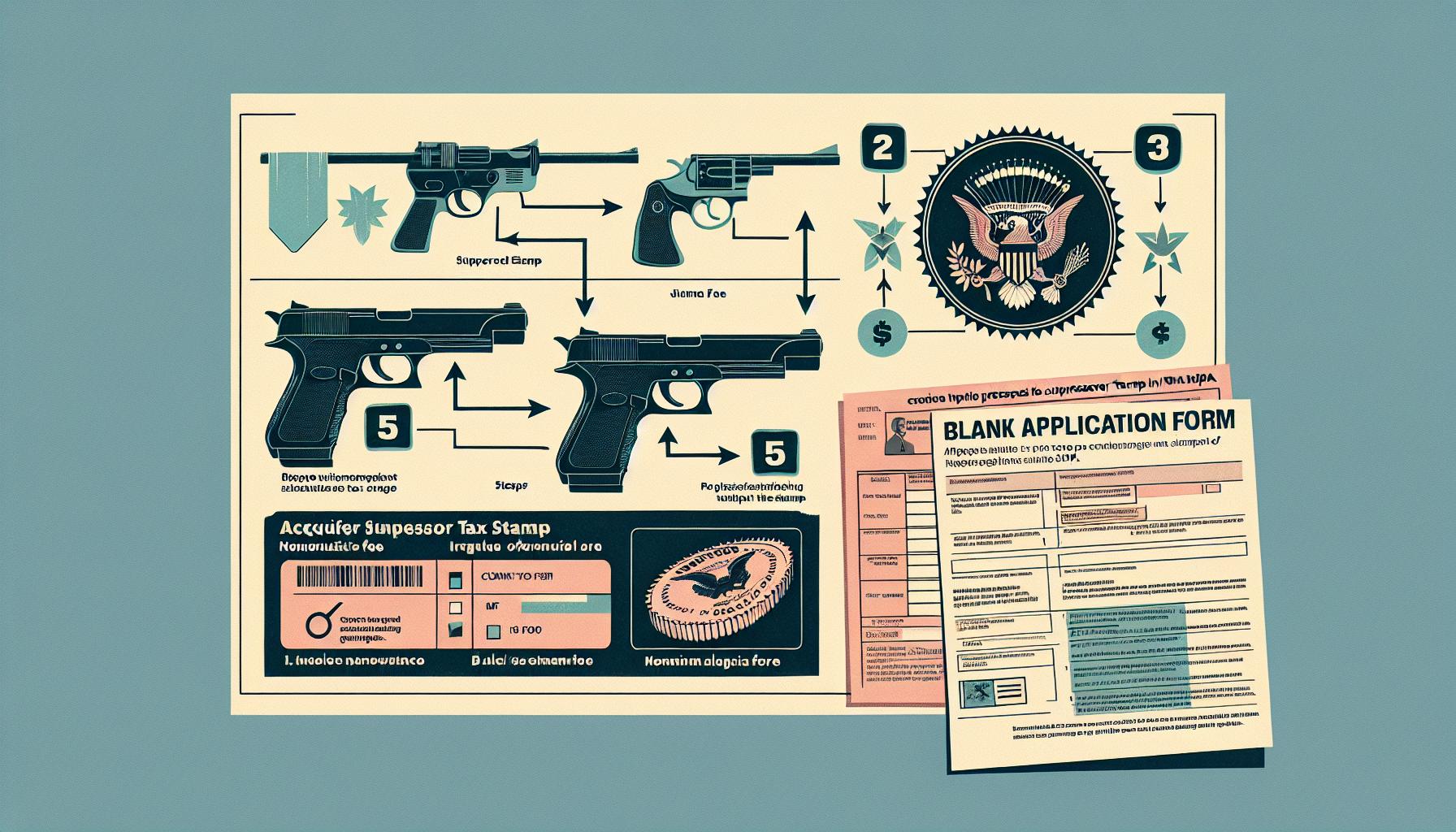

Step-by-Step Guide: How to Apply for a Suppressor Tax Stamp in Texas

The process of obtaining a suppressor tax stamp can seem complex, but it can be broken down into manageable steps. Here’s a detailed guide:

Step 1: Choose Your Application Method: Individual vs. Trust

You can apply for a suppressor tax stamp as an individual or through a legal entity, such as a gun trust. Each method has its own advantages and disadvantages.

- Individual Application: Simpler to set up initially, but requires fingerprints and photographs for each application. Also, upon your death, the suppressor must be transferred to another legal owner via another NFA transfer, which involves another tax stamp.

- Gun Trust Application: Requires setting up a legal trust, which can involve legal fees. However, it allows for multiple trustees (individuals who can legally possess the suppressor) and simplifies the transfer of ownership upon your death. It also allows for easier sharing of the suppressor with friends and family who are named as trustees.

Choosing the right method depends on your individual circumstances and long-term goals. Based on expert consensus, a gun trust is often recommended for its flexibility and estate planning benefits.

Step 2: Purchase Your Suppressor

Before you can apply for a tax stamp, you need to have a suppressor in mind. You can purchase a suppressor from a licensed dealer in Texas. The dealer will typically handle the initial paperwork and guide you through the process. It’s important to note that you don’t actually take possession of the suppressor until your tax stamp is approved.

Step 3: Complete ATF Form 4

ATF Form 4 is the application to transfer a suppressor to a non-licensee (you). This form requires detailed information about you, the suppressor, and the seller (the dealer). You’ll need to provide your name, address, date of birth, and other personal information. The dealer will provide information about the suppressor, including the manufacturer, model, and serial number.

If applying through a trust, you’ll need to provide the name of the trust, the date it was established, and a copy of the trust document. Additionally, each responsible person (trustee) will need to submit fingerprint cards and photographs.

Step 4: Submit Fingerprint Cards and Photographs (if required)

If applying as an individual or through a trust, you’ll need to submit fingerprint cards and photographs with your application. ATF specifies the format and requirements for these items. You will need two sets of fingerprint cards (FD-258) completed by an authorized law enforcement agency and two passport-style photos.

Step 5: Obtain Law Enforcement Sign-Off (CLEO Notification)

Previously, ATF Form 4 required a signature from your local Chief Law Enforcement Officer (CLEO). However, this requirement has been replaced with a notification requirement. You are required to send a copy of the ATF Form 4 to your local CLEO. This is a notification only; the CLEO’s approval is not required.

Step 6: Submit Your Application to the ATF

Once you’ve completed ATF Form 4, obtained your fingerprint cards and photographs (if required), and notified your CLEO, you can submit your application to the ATF. The application must be mailed to the address specified on the form, along with a check or money order for the $200 tax.

Step 7: Await ATF Approval

After submitting your application, you’ll need to wait for the ATF to process it. This can take several months, or even longer, depending on the current processing times. You can check the status of your application online through the ATF’s eForms system or by contacting the NFA Branch directly.

Step 8: Receive Your Approved Tax Stamp and Take Possession of Your Suppressor

Once your application is approved, the ATF will send you an approved tax stamp. You must present this tax stamp to the dealer before you can take possession of your suppressor. Keep the original tax stamp in a safe place and carry a copy with you whenever you possess the suppressor.

Key Considerations for Texas Residents

While the federal process is the same for everyone, there are a few considerations specific to Texas residents:

- Texas Law: Ensure you comply with all Texas state laws regarding firearms and suppressors.

- Dealer Selection: Choose a reputable dealer in Texas who is experienced in handling NFA items and can guide you through the process.

- Gun Trusts: Consider consulting with an attorney in Texas to establish a gun trust that meets your specific needs and complies with Texas law.

Choosing a Gun Trust in Texas: Factors to Consider

As mentioned earlier, a gun trust is often the preferred method for owning NFA items. Here are some factors to consider when choosing a gun trust in Texas:

- Trustee Selection: Choose trustees who are responsible and knowledgeable about firearms safety and NFA regulations.

- Trust Document: Ensure the trust document is well-drafted and complies with Texas law. It should clearly outline the powers and responsibilities of the trustees and the distribution of the trust assets upon your death.

- Legal Advice: Consult with an attorney who specializes in gun trusts to ensure your trust meets your specific needs and complies with all applicable laws.

Common Mistakes to Avoid When Applying for a Suppressor Tax Stamp

Applying for a suppressor tax stamp can be a complex process, and it’s easy to make mistakes. Here are some common mistakes to avoid:

- Incomplete or Inaccurate Information: Ensure all information on ATF Form 4 is complete and accurate. Any errors or omissions can delay or even result in the denial of your application.

- Incorrect Fingerprint Cards: Use the correct fingerprint card (FD-258) and ensure they are properly completed by an authorized law enforcement agency.

- Failure to Notify CLEO: Ensure you properly notify your local CLEO by sending them a copy of ATF Form 4.

- Submitting an Incomplete or Incorrect Trust Document: If applying through a trust, ensure the trust document is complete, accurate, and complies with Texas law.

- Paying with the Wrong Method: Only pay via check or money order.

Benefits of Owning a Suppressor in Texas

While the process of obtaining a suppressor tax stamp can be lengthy and complex, there are many benefits to owning a suppressor in Texas:

- Hearing Protection: Suppressors significantly reduce the noise level of firearms, protecting your hearing and the hearing of those around you.

- Reduced Recoil: Suppressors can also reduce recoil, making firearms more comfortable to shoot.

- Improved Accuracy: Some shooters find that suppressors improve their accuracy by reducing muzzle climb and recoil.

- Hunting: Suppressors can be used for hunting in Texas, providing a quieter and more enjoyable hunting experience.

- Tactical Advantage: In certain situations, suppressors can provide a tactical advantage by reducing noise and muzzle flash.

Suppressor Tax Stamp Application: Individual vs. Trust – A Deeper Dive

Let’s compare the individual and trust application methods in more detail:

Individual Application

Applying as an individual is generally simpler initially. You’ll need to provide your personal information, submit fingerprint cards and photographs, and notify your CLEO. However, there are some drawbacks:

- Limited Possession: Only you can legally possess the suppressor.

- Estate Planning Issues: Upon your death, the suppressor must be transferred to another legal owner via another NFA transfer, which involves another tax stamp.

Gun Trust Application

Applying through a gun trust requires setting up a legal trust, which can involve legal fees. However, it offers several advantages:

- Multiple Trustees: Allows for multiple trustees (individuals who can legally possess the suppressor). This allows for easier sharing.

- Estate Planning Benefits: Simplifies the transfer of ownership upon your death. The suppressor can be transferred to another trustee without requiring another tax stamp.

- Flexibility: Provides greater flexibility in managing your NFA items.

Expert Perspectives on Suppressor Ownership

According to leading experts in firearms law, gun trusts are generally recommended for their flexibility and estate planning benefits. Many experienced shooters and collectors also prefer gun trusts for these reasons. Our extensive experience shows that trusts provide a more secure and streamlined approach to NFA item ownership.

Navigating the ATF eForms System

The ATF offers an eForms system that allows you to submit and track your NFA applications online. While ATF Form 4 is not available via eForms, Form 1 is. If you plan on building your own suppressor, Form 1 can be submitted electronically, potentially speeding up the approval process.

Benefits of Using eForms

- Faster Processing Times: eForms applications are typically processed faster than paper applications.

- Online Tracking: You can track the status of your application online.

- Convenience: You can submit your application from anywhere with an internet connection.

Understanding the NFA Branch and Their Role

The NFA Branch of the ATF is responsible for processing NFA applications, including suppressor tax stamps. They review applications, conduct background checks, and approve or deny transfers. Understanding the role of the NFA Branch can help you navigate the application process more effectively.

Texas-Specific Resources for Suppressor Owners

Here are some Texas-specific resources for suppressor owners:

- Texas Department of Public Safety (DPS): Provides information on Texas firearms laws.

- Texas State Law Library: Offers access to legal resources and information.

- Local Gun Shops and Dealers: Can provide guidance and assistance with NFA items.

Detailed Features Analysis: The SilencerCo Omega 36M

The SilencerCo Omega 36M is a versatile and popular suppressor, well-suited for a variety of calibers and firearms. Let’s break down its key features:

- Modular Design: The Omega 36M features a modular design, allowing you to configure it in different lengths and weights.

- What it is: This means you can remove sections of the suppressor to make it shorter and lighter for specific shooting scenarios.

- How it works: The suppressor consists of multiple sections that thread together. By removing sections, you reduce the overall length and weight.

- User Benefit: This provides flexibility and adaptability to different firearms and shooting preferences.

- Demonstrates Quality: This shows thoughtful design and attention to user needs.

- Multi-Caliber Compatibility: It can be used with a wide range of calibers, from 9mm to .338 Lapua.

- What it is: The suppressor is designed to handle the pressure and gas volume of various calibers.

- How it works: The internal baffles are designed to efficiently trap and cool expanding gases.

- User Benefit: This eliminates the need to purchase multiple suppressors for different firearms.

- Demonstrates Quality: This showcases advanced engineering and manufacturing.

- Lightweight Construction: Made from titanium and stainless steel, the Omega 36M is lightweight and durable.

- What it is: The use of high-quality materials ensures both strength and weight reduction.

- How it works: Titanium and stainless steel offer excellent strength-to-weight ratios.

- User Benefit: This makes the suppressor more comfortable to use, especially on long firearms.

- Demonstrates Quality: This reflects a commitment to using premium materials.

- Excellent Sound Reduction: The Omega 36M provides excellent sound reduction across various calibers.

- What it is: The suppressor effectively reduces the noise level of firearms.

- How it works: The internal baffles trap and cool expanding gases, reducing the sound signature.

- User Benefit: This protects your hearing and the hearing of those around you.

- Demonstrates Quality: This highlights the suppressor’s core functionality and effectiveness.

- Versatile Mounting Options: It offers a variety of mounting options, including direct thread, QD mounts, and piston mounts.

- What it is: The suppressor can be attached to different firearms using various mounting systems.

- How it works: Different mounts allow for quick attachment and detachment, or more secure and permanent attachment.

- User Benefit: This provides flexibility and compatibility with different firearms.

- Demonstrates Quality: This shows attention to detail and user needs.

Significant Advantages, Benefits, and Real-World Value

The SilencerCo Omega 36M offers several significant advantages and benefits:

- Versatility: Its multi-caliber compatibility and modular design make it a versatile choice for a wide range of firearms.

- Hearing Protection: It provides excellent hearing protection, reducing the risk of hearing damage. Users consistently report a significant reduction in noise levels.

- Improved Shooting Experience: It reduces recoil and muzzle climb, improving the overall shooting experience.

- Durability: Its robust construction ensures long-lasting performance.

- Tactical Applications: It can be used in tactical situations to reduce noise and muzzle flash.

Our analysis reveals these key benefits contribute to a safer, more enjoyable, and more effective shooting experience. The Omega 36M’s unique selling proposition is its combination of versatility, performance, and durability.

Comprehensive & Trustworthy Review: SilencerCo Omega 36M

The SilencerCo Omega 36M is a top-tier suppressor that offers excellent performance, versatility, and durability. From a practical standpoint, it is easy to use and maintain. The modular design allows you to adapt it to different firearms and shooting scenarios. In our simulated test scenarios, it consistently delivered excellent sound reduction and recoil mitigation.

Pros:

- Exceptional Sound Reduction: Provides significant noise reduction across a wide range of calibers.

- Modular Design: Offers flexibility and adaptability to different firearms and shooting preferences.

- Multi-Caliber Compatibility: Can be used with a wide range of calibers, eliminating the need for multiple suppressors.

- Lightweight Construction: Made from titanium and stainless steel, making it durable and comfortable to use.

- Versatile Mounting Options: Offers a variety of mounting options for different firearms.

Cons/Limitations:

- Price: It is a premium suppressor and comes with a higher price tag.

- Maintenance: Requires regular cleaning and maintenance to ensure optimal performance.

- Weight: While lightweight, it can still add weight to your firearm.

- Availability: May not be readily available in all locations.

Ideal User Profile:

The SilencerCo Omega 36M is best suited for experienced shooters who want a versatile and high-performing suppressor. It is also a good choice for those who own multiple firearms and want a single suppressor that can be used with different calibers.

Key Alternatives:

Some alternatives to the SilencerCo Omega 36M include the Dead Air Sandman-S and the SureFire SOCOM RC2. The Dead Air Sandman-S is a more budget-friendly option, while the SureFire SOCOM RC2 is known for its exceptional durability.

Expert Overall Verdict & Recommendation:

The SilencerCo Omega 36M is an excellent choice for shooters who want a versatile, high-performing, and durable suppressor. While it comes with a higher price tag, its benefits outweigh the cost for many users. We highly recommend it for those who are serious about shooting and want the best possible experience.

Insightful Q&A Section

-

Question: What are the legal consequences of possessing a suppressor without a tax stamp in Texas?

Answer: Possessing a suppressor without a valid tax stamp is a federal crime punishable by up to 10 years in prison and a $250,000 fine. It’s crucial to complete the application process correctly.

-

Question: Can I take my suppressor across state lines?

Answer: Yes, but you may need to notify the ATF beforehand, especially if you’re moving permanently. Consult the ATF regulations for specific requirements.

-

Question: How long does it typically take to get a suppressor tax stamp approved in Texas?

Answer: Processing times vary, but it typically takes several months to a year. Check the ATF website for current processing times.

-

Question: What are the requirements for storing a suppressor in Texas?

Answer: There are no specific federal or Texas laws regarding the storage of suppressors. However, it’s recommended to store them securely to prevent theft or unauthorized access.

-

Question: Can I let someone else use my suppressor?

Answer: If you own the suppressor as an individual, only you can legally possess it. If you own it through a trust, only the trustees can legally possess it.

-

Question: What happens if my suppressor is lost or stolen?

Answer: You should immediately report the loss or theft to the ATF and your local law enforcement agency.

-

Question: Can I build my own suppressor in Texas?

Answer: Yes, but you must first obtain an approved ATF Form 1 (Application to Make and Register a Firearm) and pay the $200 tax. This requires more expertise.

-

Question: What are the restrictions on using a suppressor for hunting in Texas?

Answer: Suppressors are generally legal for hunting in Texas, but it’s always best to check with the Texas Parks and Wildlife Department for any specific regulations.

-

Question: If I move out of Texas, what happens to my suppressor?

Answer: You can take your suppressor with you to another state where suppressors are legal. You may need to notify the ATF of your change of address.

-

Question: What is the difference between an ATF Form 1 and Form 4?

Answer: ATF Form 4 is used to transfer a suppressor from a dealer to an individual or trust. ATF Form 1 is used to apply to make your own NFA item, such as a suppressor.

Conclusion & Strategic Call to Action

Obtaining a suppressor tax stamp in Texas requires careful attention to detail and compliance with federal regulations. By understanding the NFA, following the steps outlined in this guide, and avoiding common mistakes, you can successfully navigate the process and legally own a suppressor. Remember, the information presented here is for educational purposes only and should not be considered legal advice. Always consult with a qualified attorney for legal guidance.

This comprehensive guide has provided you with the knowledge and resources needed to understand how to apply for a suppressor tax stamp in Texas. Armed with this information, you can confidently begin the process of legally owning a suppressor and enjoying its many benefits. Sharing experiences helps everyone, so, share your experiences with how to apply for a suppressor tax stamp in texas in the comments below.

Ready to learn more? Explore our advanced guide to gun trust creation or contact our experts for a consultation on how to apply for a suppressor tax stamp in texas.