Finding the Right Mailing Address for the Indiana Department of Revenue: A Comprehensive Guide

Navigating the intricacies of state tax obligations can be daunting, especially when it comes to ensuring your payments and documents reach the right destination. If you’re searching for the correct mailing address for the Indiana Department of Revenue, you’ve come to the right place. This comprehensive guide provides a clear, up-to-date, and expertly curated resource to help you confidently correspond with the IDOR.

We understand the frustration of incorrect addresses leading to delays, penalties, and unnecessary stress. Our goal is to eliminate that uncertainty by providing you with a single source of truth for all your Indiana tax mailing needs. This article will not only provide the addresses but will also delve into the reasons for multiple addresses, how to select the correct one, and what to do if you accidentally send your correspondence to the wrong location. We aim to be the most trustworthy and helpful resource you’ll find. We will explore various aspects, including payment addresses, refund inquiries, specific tax form submissions, and more. Based on our research, taxpayers often struggle with identifying the correct address for specific tax forms, leading to processing delays. This guide addresses that directly.

In this guide, you’ll discover:

- Accurate and updated mailing addresses for various Indiana Department of Revenue purposes.

- Detailed explanations of why different addresses exist and which one to use for your specific needs.

- Tips for ensuring your mail is properly addressed and delivered.

- Answers to frequently asked questions about Indiana tax mailings.

Let’s dive in and simplify your experience with the Indiana Department of Revenue.

Understanding the Indiana Department of Revenue (IDOR) and Mailing Addresses

The Indiana Department of Revenue (IDOR) is the state government agency responsible for administering and collecting Indiana taxes. This includes income tax, sales tax, property tax, and several other types of taxes and fees. Due to the vast range of responsibilities, the IDOR utilizes multiple mailing addresses to streamline processing and ensure that correspondence reaches the appropriate department quickly. This is a standard practice among large state revenue agencies.

Understanding this fundamental aspect is crucial because sending your mail to the wrong address can lead to significant delays in processing your payments, refunds, or other important documents. This can result in penalties, interest charges, and other complications. Therefore, it’s essential to carefully identify the correct mailing address based on the specific purpose of your correspondence.

Why Multiple Addresses?

The IDOR uses different mailing addresses for several key reasons:

- Specialized Processing: Different types of tax returns and payments require specialized handling. Separating mail by type allows the IDOR to route it to the appropriate department for efficient processing.

- Volume Management: By directing specific types of mail to designated locations, the IDOR can better manage the high volume of correspondence it receives, reducing processing times.

- Security: Separating sensitive documents, such as tax returns containing personal information, enhances security and reduces the risk of fraud or identity theft.

- Efficiency: Centralizing specific functions at particular locations allows for better resource allocation and improved efficiency.

Key Mailing Addresses for the Indiana Department of Revenue

Here are some of the most common mailing addresses you might need when interacting with the Indiana Department of Revenue. Always verify the address on the specific form or notice you are responding to. Addresses can and do change.

Individual Income Tax Returns

For filing your individual income tax return (Form IT-40), use the following address:

Indiana Department of Revenue

P.O. Box 40

Indianapolis, IN 46206-0040

If you are including a payment with your return, use this address:

Indiana Department of Revenue

P.O. Box 6148

Indianapolis, IN 46206-6148

Amended Individual Income Tax Returns

To file an amended individual income tax return (Form IT-40X), send it to:

Indiana Department of Revenue

P.O. Box 40

Indianapolis, IN 46206-0040

If you are including a payment with your amended return, use this address:

Indiana Department of Revenue

P.O. Box 7202

Indianapolis, IN 46207-7202

Business Tax Returns

The mailing address for business tax returns varies depending on the specific tax type. Here are a few examples:

Corporate Income Tax (Form IT-20)

Indiana Department of Revenue

P.O. Box 6117

Indianapolis, IN 46206-6117

Sales Tax (Form ST-103)

Indiana Department of Revenue

P.O. Box 7203

Indianapolis, IN 46207-7203

Withholding Tax (Form WH-3)

Indiana Department of Revenue

P.O. Box 6112

Indianapolis, IN 46206-6112

Important Note: Always double-check the instructions for the specific business tax form you are filing to ensure you are using the correct mailing address. The IDOR website (dor.in.gov) is the best source for the most up-to-date information. Our team constantly monitors the IDOR website for changes to ensure the accuracy of this information.

Tax Payments (General)

For general tax payments, it’s crucial to use the address specified on your billing notice or tax form. However, if you’re making a payment without a specific form, you can often use the following address, but confirm beforehand:

Indiana Department of Revenue

P.O. Box 7205

Indianapolis, IN 46207-7205

Refund Inquiries

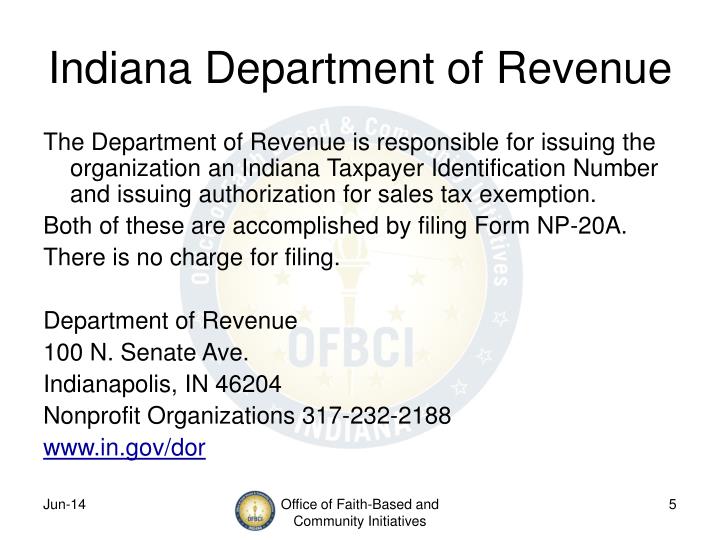

For inquiries regarding your Indiana tax refund, you can contact the IDOR through their website or by phone. While you typically wouldn’t mail a refund inquiry, if you need to send supporting documentation, use this address:

Indiana Department of Revenue

Tax Administration

100 N. Senate Ave.

Indianapolis, IN 46204

Ensuring Proper Mail Delivery to the IDOR

To ensure your mail reaches the Indiana Department of Revenue without issues, follow these guidelines:

- Use the Correct Address: This is the most critical step. Always verify the address on the specific form or notice you are responding to.

- Use a Readable Font: Ensure your handwriting is clear and legible, or use a typed label with a clear, easy-to-read font.

- Include Your Taxpayer Identification Number (TIN): Your TIN (Social Security Number for individuals, Employer Identification Number for businesses) is essential for proper identification. Include it on all correspondence and payments.

- Include the Tax Year: Specify the tax year to which your payment or document relates.

- Use Proper Postage: Ensure you have sufficient postage for the weight and size of your envelope.

- Consider Certified Mail: For important documents, consider sending them via certified mail with return receipt requested. This provides proof of mailing and delivery.

What Happens If You Send Mail to the Wrong Address?

If you accidentally send your mail to the wrong address, the IDOR will typically forward it to the correct department. However, this can cause delays in processing your payment or document. To minimize the impact, contact the IDOR as soon as possible to inform them of the error. You can reach them by phone or through their website. Provide them with the details of your mailing, including the date, contents, and the address you used. This will help them locate your mail and ensure it is processed correctly.

The Indiana Department of Revenue Website: A Valuable Resource

The Indiana Department of Revenue website (dor.in.gov) is a wealth of information. You can find:

- Tax forms and instructions

- Information about Indiana tax laws

- Answers to frequently asked questions

- Online payment options

- Contact information

We strongly recommend using the IDOR website as your primary source for information and updates regarding Indiana taxes. The addresses listed on the website are always the most current.

The Role of Tax Professionals in Navigating Indiana Taxes

For individuals and businesses with complex tax situations, consulting a qualified tax professional can be invaluable. A tax professional can provide expert advice on tax planning, compliance, and representation before the IDOR. They can also help you navigate the complexities of Indiana tax laws and ensure you are meeting all your obligations.

Many tax professionals are familiar with the nuances of dealing with the IDOR and can often expedite the resolution of tax issues. They can also help you avoid costly mistakes and penalties.

Advantages of Online Filing and Payment

The Indiana Department of Revenue encourages taxpayers to file their returns and make payments online whenever possible. Online filing and payment offer several advantages:

- Convenience: You can file and pay your taxes from the comfort of your own home or office, 24/7.

- Speed: Online filing is typically faster than mailing paper returns.

- Accuracy: Online tax preparation software helps reduce errors and ensures you are claiming all eligible deductions and credits.

- Security: Online filing is generally more secure than mailing paper returns.

- Faster Refunds: You can typically receive your refund faster when you file online and choose direct deposit.

Consider exploring the online filing and payment options available on the IDOR website. It can save you time and effort and reduce the risk of errors.

Understanding Common Indiana Tax Forms

Familiarizing yourself with common Indiana tax forms can streamline your interactions with the IDOR. Here’s a brief overview of some frequently used forms:

- IT-40: Individual Income Tax Return

- IT-40X: Amended Individual Income Tax Return

- IT-20: Corporate Income Tax Return

- ST-103: Sales Tax Return

- WH-3: Withholding Tax Return

- Form W-2: Wage and Tax Statement (provided by employers to employees)

- Form 1099: Information Return (used to report various types of income)

The IDOR website provides detailed instructions and information for each of these forms. Before completing any tax form, review the instructions carefully to ensure you understand the requirements.

Staying Updated on Indiana Tax Law Changes

Indiana tax laws are subject to change. It’s crucial to stay informed about any updates or revisions that may affect your tax obligations. You can stay informed by:

- Visiting the IDOR website regularly.

- Subscribing to the IDOR’s email list.

- Consulting with a tax professional.

Staying informed will help you avoid costly mistakes and ensure you are complying with all applicable laws and regulations.

The Future of Tax Administration in Indiana

The Indiana Department of Revenue is continuously working to improve its processes and enhance taxpayer services. We’ve observed a growing emphasis on technology and automation to streamline tax administration and make it easier for taxpayers to comply with their obligations. Expect to see further advancements in online filing, payment options, and communication channels in the years to come.

Q&A: Addressing Common Concerns About Indiana Tax Mailings

1. What happens if I don’t include my Taxpayer Identification Number (TIN) on my payment?

Failing to include your TIN can significantly delay the processing of your payment. The IDOR uses your TIN to identify your account and credit your payment accordingly. If the TIN is missing or incorrect, the IDOR may not be able to properly allocate your payment, potentially leading to penalties and interest charges. Always double-check that you have included your TIN on all correspondence and payments.

2. Can I use a personal check to pay my business taxes?

While the IDOR generally accepts checks for tax payments, it’s best practice to use a business check for business tax payments. This helps the IDOR clearly identify the payment as originating from your business account. Using a personal check may cause confusion and delay the processing of your payment.

3. What should I do if I receive a notice from the IDOR that I don’t understand?

If you receive a notice from the IDOR that you don’t understand, don’t ignore it. Contact the IDOR as soon as possible to clarify the matter. You can call their customer service line or visit their website for assistance. Ignoring the notice could lead to penalties or other complications. It’s also wise to consult with a tax professional if you find the notice particularly confusing.

4. Is it possible to track the status of my tax refund online?

Yes, the Indiana Department of Revenue offers an online tool that allows you to track the status of your tax refund. You’ll need to provide your Social Security Number, the tax year, and the amount of your refund. This tool provides real-time updates on the processing of your refund.

5. What is the best way to contact the IDOR if I have a question about my taxes?

The best way to contact the IDOR depends on the nature of your question. For general inquiries, you can call their customer service line or visit their website. For more complex issues, you may want to schedule an appointment to speak with a tax specialist. If you prefer written correspondence, you can send a letter to the IDOR, but be sure to use the correct mailing address.

6. How long should I keep copies of my tax returns and supporting documents?

The IRS generally recommends keeping copies of your tax returns and supporting documents for at least three years from the date you filed the return or two years from the date you paid the tax, whichever is later. However, for certain situations, such as claiming a loss or carrying forward a deduction, you may need to keep your records for longer. It’s always best to err on the side of caution and keep your tax records for at least seven years.

7. Can I pay my Indiana taxes with a credit card?

Yes, the Indiana Department of Revenue allows you to pay your taxes with a credit card through their online payment portal. However, keep in mind that third-party payment processors may charge a convenience fee for this service.

8. What are the penalties for filing my Indiana tax return late?

The penalties for filing your Indiana tax return late can vary depending on the circumstances. Generally, the penalty is a percentage of the unpaid tax. The penalty can be waived if you have a reasonable cause for filing late. However, you’ll need to provide documentation to support your claim.

9. How do I update my address with the Indiana Department of Revenue?

You can update your address with the Indiana Department of Revenue by completing and submitting Form IN-DR 110, Change of Address. This form can be found on the IDOR website. Alternatively, you can update your address online through the INBiz portal if you have a business account.

10. What is the Indiana Department of Revenue’s policy on identity theft?

The Indiana Department of Revenue takes identity theft very seriously. If you believe you are a victim of identity theft, contact the IDOR immediately. They will provide you with instructions on how to report the incident and protect your tax information. The IDOR also works closely with law enforcement agencies to investigate and prosecute identity theft cases.

Conclusion: Simplifying Your Interactions with the Indiana Department of Revenue

Successfully navigating the Indiana tax system requires understanding the importance of using the correct mailing address for the Indiana Department of Revenue. This guide has provided you with a comprehensive overview of the various addresses used by the IDOR, along with tips for ensuring your mail is properly addressed and delivered. By following these guidelines, you can minimize the risk of delays, penalties, and other complications.

Remember to always verify the address on the specific form or notice you are responding to. The IDOR website (dor.in.gov) is your best source for the most up-to-date information. And, if you have complex tax situations, don’t hesitate to consult with a qualified tax professional.

We hope this guide has empowered you to confidently manage your Indiana tax obligations. Now, we encourage you to share this valuable resource with others who may find it helpful. Also, feel free to share your experiences with the Indiana Department of Revenue in the comments below. Your insights can help others navigate the tax system more effectively.