Track Your Minnesota Tax Refund: A Comprehensive Guide to Tax Return Status MN

Are you eagerly awaiting your Minnesota tax refund and wondering about its status? You’re not alone. Navigating the world of tax returns can be confusing, especially when you’re trying to determine when you’ll receive your hard-earned money. This comprehensive guide is designed to provide you with all the information you need to understand and track your tax return status MN. We’ll cover everything from the basics of checking your refund status to troubleshooting common issues and understanding potential delays. Our goal is to provide you with a clear, authoritative, and trustworthy resource, ensuring you have a smooth and stress-free experience.

Understanding Minnesota Tax Returns

Before diving into how to check your tax return status MN, it’s crucial to understand the basics of Minnesota tax returns. The Minnesota Department of Revenue (MDOR) is responsible for administering and collecting taxes within the state. Residents who earn income in Minnesota are generally required to file a state income tax return each year.

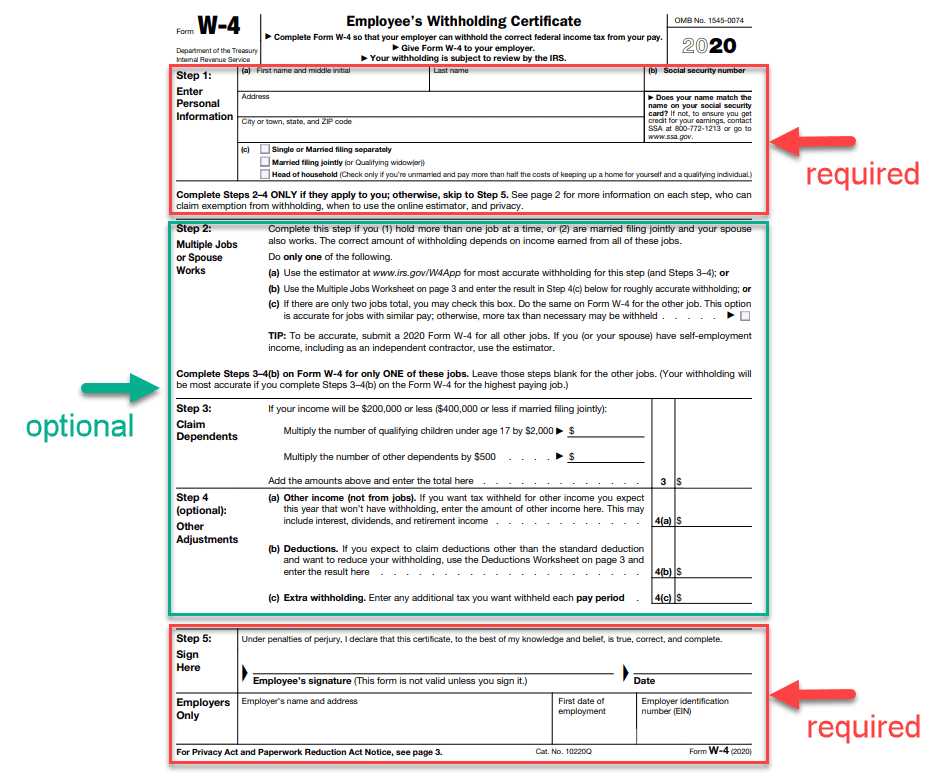

The purpose of filing a tax return is to reconcile your income and withholdings with your tax obligations. If you’ve overpaid your taxes throughout the year (through payroll withholdings or estimated tax payments), you’re entitled to a refund. The amount of your refund depends on various factors, including your income, deductions, and credits. Understanding these factors will allow you to anticipate your refund and know when to check your tax return status MN.

Key Factors Affecting Your Minnesota Tax Refund

- Income: Your total income is the starting point for calculating your tax liability.

- Withholdings: The amount of taxes withheld from your paycheck throughout the year.

- Deductions: Expenses you can subtract from your income to reduce your tax liability. Common deductions include the standard deduction, itemized deductions (such as medical expenses or charitable contributions), and deductions for student loan interest.

- Credits: Direct reductions of your tax liability. Tax credits can be more valuable than deductions because they directly lower the amount of tax you owe. Examples include the Working Family Credit and the Child and Dependent Care Credit.

Understanding how these factors impact your tax liability will help you better estimate your refund and interpret your tax return status MN updates.

How to Check Your Tax Return Status MN: A Step-by-Step Guide

The Minnesota Department of Revenue offers several convenient ways to check your tax return status MN. Here’s a detailed guide to help you navigate the process:

1. Online Through the Minnesota Department of Revenue Website

The MDOR website is the most popular and efficient way to check your tax return status MN. Here’s how:

- Visit the MDOR Website: Go to the official Minnesota Department of Revenue website (search for “Minnesota Department of Revenue”).

- Navigate to the “Where’s My Refund?” Tool: Look for a link or section titled “Where’s My Refund?” or “Check Your Refund Status.” This tool is specifically designed for tracking your refund.

- Enter Required Information: You’ll typically need to provide the following information:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): This is used to identify your tax return.

- Filing Year: The year for which you filed the tax return.

- Refund Amount: The exact amount of the refund you’re expecting. This is crucial for security purposes and to ensure you’re accessing the correct information.

- Submit and View Your Status: After entering the required information, submit the form. The system will then display your tax return status MN.

The online tool provides real-time updates on your refund’s progress, including whether it’s been received, processed, and approved for payment.

2. By Phone

While the online tool is generally the fastest and most convenient option, you can also check your tax return status MN by phone. However, be prepared for potential wait times, especially during peak tax season.

- Find the MDOR Phone Number: Visit the Minnesota Department of Revenue website to find the appropriate phone number for tax-related inquiries.

- Call the MDOR: Call the number and follow the prompts to speak with a representative.

- Provide Required Information: The representative will ask for your SSN or ITIN, filing year, and refund amount to verify your identity and locate your tax return.

- Inquire About Your Refund Status: Ask the representative for an update on your tax return status MN.

Keep in mind that phone support may have limited availability, and the information provided may be the same as what’s available online. However, it can be a useful option if you have specific questions or need clarification.

Understanding Your Tax Return Status MN Updates

When you check your tax return status MN, you’ll typically see one of the following updates:

- Return Received: This means the MDOR has received your tax return and it’s in their system.

- Return Being Processed: Your return is being reviewed and verified. This stage can take some time, especially if there are any discrepancies or issues.

- Refund Approved: Your refund has been approved and is scheduled for payment. This is the stage you’ve been waiting for!

- Refund Sent: Your refund has been issued, either by direct deposit or paper check.

It’s important to note that these are general updates, and the specific wording may vary slightly. If you have any questions about your tax return status MN, don’t hesitate to contact the MDOR for clarification.

Common Reasons for Tax Refund Delays in Minnesota

While the MDOR aims to process refunds as quickly as possible, delays can occur. Understanding the common reasons for delays can help you anticipate potential issues and take steps to avoid them.

1. Errors or Incomplete Information

One of the most common reasons for tax refund delays is errors or incomplete information on your tax return. This can include:

- Incorrect SSN or ITIN

- Missing schedules or forms

- Math errors

- Illegible handwriting

Carefully review your tax return before submitting it to ensure all information is accurate and complete. This can significantly reduce the risk of delays in your tax return status MN.

2. Identity Verification

To prevent fraud and identity theft, the MDOR may require additional identity verification before processing your refund. This is especially common for first-time filers or those who have recently moved to Minnesota.

If you’re asked to verify your identity, promptly respond to the MDOR’s request and provide the necessary documentation. This will help expedite the processing of your refund and update your tax return status MN.

3. Review for Accuracy

The MDOR may review your tax return for accuracy, especially if you’re claiming significant deductions or credits. This review can take time, as the MDOR may need to verify the information you’ve provided.

To avoid delays, ensure you have proper documentation to support your deductions and credits. This includes receipts, statements, and other records that substantiate your claims.

4. High Volume of Returns

During peak tax season, the MDOR receives a high volume of returns, which can lead to processing delays. While the MDOR works hard to process returns as quickly as possible, it may take longer to receive your refund during these busy periods.

Filing your tax return early can help you avoid some of the delays associated with peak tax season. This will also give you more time to check your tax return status MN and address any issues that may arise.

5. Amended Tax Returns

If you file an amended tax return (Form M1X), it will take longer to process than an original tax return. Amended returns require manual review, which can add several weeks to the processing time.

Only file an amended tax return if it’s absolutely necessary. If you make a mistake on your original return, it’s often better to wait until the MDOR contacts you before filing an amendment.

What to Do If Your Tax Refund Is Delayed

If you’ve checked your tax return status MN and it’s been longer than the expected processing time, here are some steps you can take:

- Check Your Online Account: Log in to your online account on the MDOR website to see if there are any notices or requests for information.

- Contact the MDOR: If you can’t find any information online, contact the MDOR by phone or mail to inquire about the status of your refund.

- Gather Documentation: Be prepared to provide your SSN or ITIN, filing year, refund amount, and any other relevant information to help the MDOR locate your tax return.

- Be Patient: Processing delays can occur, especially during peak tax season. Be patient and allow the MDOR time to review your return and process your refund.

Remember, the MDOR is there to help you. Don’t hesitate to reach out if you have any questions or concerns about your tax return status MN.

The Role of Tax Preparation Software in Managing Your Minnesota Taxes

Tax preparation software, like TurboTax or H&R Block, simplifies the tax filing process. These programs guide you through each step, ensuring you claim all eligible deductions and credits. This can significantly impact your refund amount and your overall tax return status MN.

Many tax preparation software programs also offer features for tracking your refund status. They can automatically check your tax return status MN and notify you of any updates. This can save you time and effort, and help you stay informed about the progress of your refund.

Understanding Minnesota Tax Laws and Credits

Minnesota offers several tax credits and deductions that can reduce your tax liability and increase your refund. Understanding these credits and deductions is essential for maximizing your tax benefits and accurately determining your tax return status MN.

The Working Family Credit

The Working Family Credit is a refundable tax credit for low- to moderate-income working families. The amount of the credit depends on your income and family size. This credit can significantly increase your refund and improve your financial well-being.

The Child and Dependent Care Credit

The Child and Dependent Care Credit is a tax credit for expenses you pay for child care or dependent care so you can work or look for work. The amount of the credit depends on your income and the amount of expenses you pay.

The Education Credit

Minnesota offers several education-related tax credits, including the K-12 Education Credit and the Higher Education Credit. These credits can help offset the cost of education and reduce your tax liability.

By understanding and claiming these credits, you can significantly reduce your tax liability and potentially increase your refund, which in turn affects your tax return status MN.

Expert Review of the Minnesota Department of Revenue Website and Services

The Minnesota Department of Revenue provides a comprehensive online portal for managing your taxes. From our experience, the website is generally user-friendly, with clear navigation and helpful resources. The “Where’s My Refund?” tool is particularly useful for checking your tax return status MN.

However, the website can be overwhelming for first-time users. The sheer amount of information can be difficult to navigate, and it may take some time to find what you’re looking for. Additionally, the phone support can be difficult to reach during peak tax season.

Pros:

- Comprehensive Online Resources: The MDOR website offers a wealth of information about Minnesota taxes, including forms, instructions, and FAQs.

- User-Friendly “Where’s My Refund?” Tool: The online tool for checking your tax return status MN is easy to use and provides real-time updates.

- Variety of Payment Options: The MDOR offers a variety of payment options, including online, by mail, and in person.

- Tax Credits and Deductions Information: The website provides information about various tax credits and deductions available to Minnesota residents.

- Secure Online Portal: The online portal is secure and protects your personal and financial information.

Cons:

- Overwhelming Amount of Information: The website can be overwhelming for first-time users due to the sheer amount of information available.

- Difficult Phone Support: Phone support can be difficult to reach during peak tax season.

- Complex Tax Laws: Minnesota tax laws can be complex and difficult to understand.

- Potential for Processing Delays: Processing delays can occur, especially during peak tax season.

Overall, the Minnesota Department of Revenue provides valuable resources and services for managing your taxes. While there are some areas for improvement, the website and online tools are generally user-friendly and helpful for checking your tax return status MN.

Alternatives for Checking Tax Return Status

While the MN DOR website is the primary method, some tax preparation software, like TurboTax, also provide refund tracking services. These often integrate directly with the IRS and state systems.

Frequently Asked Questions (FAQs) About Tax Return Status MN

- Q: How long does it typically take to receive my Minnesota tax refund?

A: The Minnesota Department of Revenue typically processes refunds within a few weeks of receiving your tax return. However, processing times can vary depending on the complexity of your return and the volume of returns being processed.

- Q: What information do I need to check my tax return status MN?

A: You’ll need your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN), the filing year, and the exact refund amount you’re expecting.

- Q: What does it mean when my tax return status MN says “Return Being Processed”?

A: This means the MDOR has received your tax return and is currently reviewing and verifying the information you’ve provided.

- Q: Can I check my tax return status MN if I filed by mail?

A: Yes, you can check your tax return status MN even if you filed by mail. The online tool and phone support are available to all taxpayers, regardless of how they filed their return.

- Q: What should I do if my tax refund is less than I expected?

A: If your tax refund is less than you expected, the MDOR will send you a notice explaining the reason for the adjustment. Review the notice carefully and contact the MDOR if you have any questions.

- Q: Is it possible to expedite my tax refund?

A: Unfortunately, it’s generally not possible to expedite your tax refund. The MDOR processes refunds in the order they are received, and there’s no way to jump the line.

- Q: What happens if I move after filing my tax return?

A: If you move after filing your tax return, you should notify the MDOR of your new address. This will ensure that your refund is sent to the correct location.

- Q: How do I update my bank account information for direct deposit?

A: You can update your bank account information for direct deposit by logging in to your online account on the MDOR website.

- Q: What is the best time to check my tax return status MN?

A: It’s generally best to wait at least 24 hours after filing your tax return before checking your tax return status MN. This allows the MDOR time to process your return and update the system.

- Q: Where can I find more information about Minnesota taxes?

A: You can find more information about Minnesota taxes on the Minnesota Department of Revenue website. The website offers a wealth of resources, including forms, instructions, FAQs, and publications.

Conclusion

Checking your tax return status MN is a straightforward process that can provide you with valuable information about the progress of your refund. By following the steps outlined in this guide, you can easily track your refund and address any issues that may arise. The Minnesota Department of Revenue provides excellent online tools and resources to assist you. Remember to file accurately and early to avoid potential delays. Staying informed and proactive will help ensure a smooth and stress-free tax season. We hope this in-depth guide has provided clarity and confidence in managing your Minnesota tax return. Now you can confidently navigate the process and track your refund with ease!

Have you had any experiences with checking your tax return status in Minnesota? Share your thoughts and tips in the comments below!