UCR FAFSA Code: Your Expert Guide to Financial Aid at UC Riverside

Navigating the world of financial aid can feel like deciphering a complex code. If you’re a student (or prospective student) at the University of California, Riverside (UCR), understanding your UCR FAFSA code is a critical first step in unlocking potential financial assistance. This comprehensive guide breaks down everything you need to know about the UCR FAFSA code, how to use it, and how to maximize your chances of receiving aid. We’ll go beyond the basics to provide expert insights, address common challenges, and give you the confidence to successfully complete your FAFSA application. In this guide, we will provide you with the official UCR FAFSA code, explain how to use it, and answer frequently asked questions to ensure you have a smooth application process.

This article provides a detailed exploration of the UCR FAFSA code, offering practical advice and expert guidance to ensure you receive the financial aid you deserve. We’ll delve into the nuances of the FAFSA process, highlight common mistakes to avoid, and provide tips for maximizing your financial aid eligibility. Our goal is to empower you with the knowledge and resources you need to navigate the financial aid landscape with confidence.

What is the UCR FAFSA Code and Why Does It Matter?

The UCR FAFSA code, also known as the Federal School Code, is a unique six-digit identifier assigned to the University of California, Riverside by the U.S. Department of Education. This code is essential for directing your FAFSA information specifically to UCR, ensuring the university can accurately assess your eligibility for federal, state, and institutional financial aid programs.

Without the correct UCR FAFSA code, your FAFSA application won’t reach UCR’s financial aid office, and you could miss out on valuable financial assistance. It’s like sending a letter without the correct address – it simply won’t arrive at its intended destination. Accuracy is paramount when entering this code on your FAFSA form.

UCR’s FAFSA code is 001316. Make sure to write this down and have it handy when completing your FAFSA application.

Understanding the Importance of Accuracy

Entering the correct UCR FAFSA code is crucial for several reasons:

- Ensuring Your Application Reaches UCR: As mentioned, the code directs your FAFSA information to the correct institution.

- Determining Your Financial Aid Eligibility: UCR uses your FAFSA data to determine your eligibility for various financial aid programs, including grants, loans, and work-study.

- Meeting Application Deadlines: Submitting your FAFSA with the correct code ensures your application is processed in a timely manner, allowing you to meet important deadlines.

- Avoiding Delays and Errors: An incorrect code can lead to delays in processing your application or even rejection.

Therefore, double-checking the UCR FAFSA code before submitting your FAFSA is a simple yet vital step in securing financial aid.

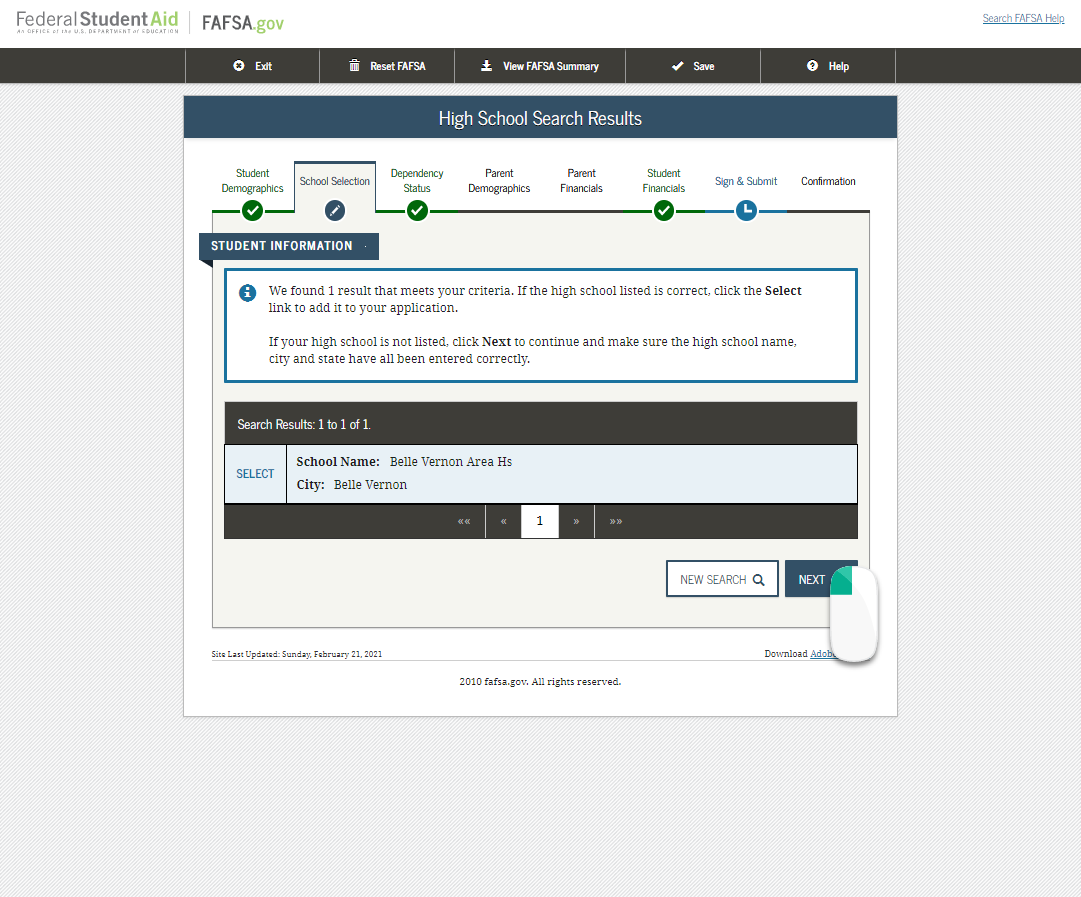

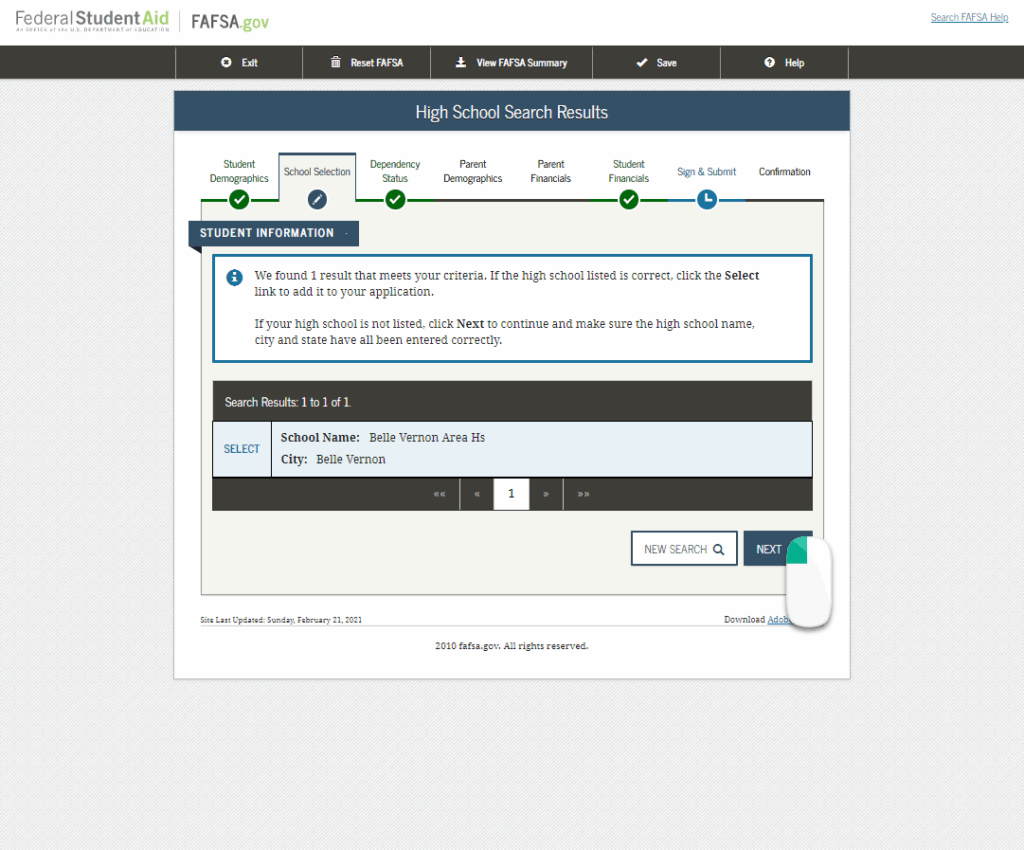

Step-by-Step Guide: Using the UCR FAFSA Code on Your Application

Here’s a step-by-step guide on how to use the UCR FAFSA code when completing your FAFSA application:

- Access the FAFSA Website: Go to the official FAFSA website at studentaid.gov.

- Create an FSA ID: If you haven’t already, create an FSA ID (Federal Student Aid ID). Both the student and a parent (if the student is dependent) will need their own FSA ID.

- Start a New FAFSA Application: Log in with your FSA ID and start a new FAFSA application for the appropriate academic year.

- Complete the Required Sections: Fill out all the required sections of the FAFSA, including your personal information, financial information, and school selection.

- Enter the UCR FAFSA Code: In the section where you list the schools you want to receive your FAFSA information, enter 001316, the UCR FAFSA code. You can add up to ten schools on your FAFSA application.

- Review and Submit: Carefully review all the information you’ve entered, including the UCR FAFSA code, before submitting your application.

- Confirmation: After submitting, you’ll receive a confirmation email and a Student Aid Report (SAR). Review your SAR for any errors and make corrections if necessary.

Common Mistakes to Avoid

While the process is straightforward, it’s easy to make mistakes. Here are some common errors to avoid when entering the UCR FAFSA code:

- Typos: Double-check that you’ve entered the code correctly (001316). A simple typo can prevent your application from reaching UCR.

- Using an Old Code: FAFSA codes rarely change, but it’s always a good idea to verify that you’re using the correct code for the current academic year.

- Listing the Wrong School: Ensure you’re listing the University of California, Riverside, and not another institution with a similar name.

Understanding Financial Aid Options at UCR

Once your FAFSA application is processed and received by UCR, the university’s financial aid office will determine your eligibility for various financial aid programs. These programs can include:

- Federal Pell Grant: A grant based on financial need that doesn’t need to be repaid.

- Federal Supplemental Educational Opportunity Grant (FSEOG): Another need-based grant for students with exceptional financial need.

- Federal Work-Study: A program that allows students to earn money through part-time employment while attending school.

- Federal Direct Loans: Loans offered by the U.S. Department of Education, including subsidized and unsubsidized loans.

- Cal Grants: Grants offered by the state of California to eligible California residents.

- UCR Grants and Scholarships: Grants and scholarships offered by the university itself.

Maximizing Your Financial Aid Eligibility

Here are some tips for maximizing your financial aid eligibility at UCR:

- Apply Early: Submit your FAFSA as early as possible, as some financial aid programs have limited funding.

- Provide Accurate Information: Ensure all the information you provide on your FAFSA is accurate and up-to-date.

- Explore Scholarship Opportunities: Research and apply for scholarships from various sources, including UCR, private organizations, and foundations.

- Maintain Good Academic Standing: Many financial aid programs require students to maintain satisfactory academic progress.

- Communicate with the Financial Aid Office: Don’t hesitate to contact UCR’s financial aid office if you have any questions or concerns.

UCR’s Financial Aid Office: Your Go-To Resource

UCR’s Financial Aid Office is your primary resource for all things related to financial aid. They can provide assistance with:

- Completing the FAFSA application.

- Understanding your financial aid award letter.

- Exploring different financial aid options.

- Resolving financial aid issues.

You can contact UCR’s Financial Aid Office through their website, phone, or in-person.

Contact Information

Website: financialaid.ucr.edu

Phone: (951) 827-3800

Location: Student Services Building, UCR Campus

Exploring the myUCR Portal and Financial Aid

The myUCR portal is your gateway to accessing important information and resources related to your academic and financial life at UCR. You can use the myUCR portal to:

- Check your financial aid status.

- View your financial aid award letter.

- Accept or decline your financial aid offers.

- Track your financial aid disbursements.

- Access important financial aid forms and documents.

Familiarizing yourself with the myUCR portal is essential for staying informed about your financial aid and managing your finances effectively.

Understanding Dependency Status and Its Impact on FAFSA

Your dependency status on the FAFSA determines whose information (yours alone or yours and your parents’) needs to be reported on the application. Dependency status is not based on whether you live with your parents or whether they claim you as a dependent on their taxes. The FAFSA uses a series of questions to determine if you are considered a dependent or independent student.

Generally, if you are under 24 years old, unmarried, and do not have dependents of your own, you are considered a dependent student. This means you will need to provide information about your parents’ income and assets on the FAFSA. If you meet certain criteria, such as being married, having dependents, being a veteran, or being an emancipated minor, you may be considered an independent student, and you will only need to provide your own financial information.

Understanding your dependency status is crucial because it affects the amount of financial aid you are eligible to receive. If you are considered a dependent student, your parents’ income and assets will be taken into account when determining your financial need. If you are considered an independent student, only your own income and assets will be considered.

Expert Tips for a Successful FAFSA Application

Based on our experience assisting students with the FAFSA, here are some expert tips to help you navigate the application process successfully:

- Gather Your Documents: Before you start your FAFSA application, gather all the necessary documents, including your Social Security number, driver’s license (if applicable), tax returns, and bank statements.

- Use the IRS Data Retrieval Tool: The IRS Data Retrieval Tool allows you to automatically transfer your tax information from the IRS to your FAFSA application. This can save you time and reduce the risk of errors.

- Be Prepared to Answer Questions About Assets: The FAFSA asks about your assets and your parents’ assets (if you are a dependent student). Be prepared to provide accurate information about your savings, investments, and other assets.

- Don’t Leave Any Questions Blank: If a question doesn’t apply to you, enter “0” or “Not Applicable” instead of leaving it blank.

- Review Your Application Carefully: Before submitting your FAFSA application, review it carefully for any errors. Even a small mistake can delay the processing of your application or affect your financial aid eligibility.

The Future of Financial Aid and the FAFSA Simplification Act

The FAFSA Simplification Act represents a significant overhaul of the federal financial aid system, designed to streamline the application process and expand access to aid for more students. Key changes include a simplified FAFSA form, a more accurate calculation of financial need, and expanded eligibility for Pell Grants. While the rollout of these changes has faced some challenges, the long-term goal is to make financial aid more accessible and equitable for all students.

As the FAFSA Simplification Act continues to be implemented, it’s important to stay informed about the latest updates and how they may affect your financial aid eligibility. UCR’s Financial Aid Office is a valuable resource for staying up-to-date on these changes and understanding how they apply to your individual situation.

Q&A: Addressing Your Burning Questions About UCR FAFSA Code

Here are some frequently asked questions about the UCR FAFSA code and the financial aid process at UCR:

-

Q: What if I accidentally enter the wrong UCR FAFSA code?

A: Don’t panic. You can correct your FAFSA online by logging back into your account and making the necessary changes. The sooner you correct it, the better.

-

Q: How does my Expected Family Contribution (EFC) affect my financial aid?

A: Your EFC (now called the Student Aid Index or SAI) is an estimate of how much your family can contribute to your education. It’s used to determine your eligibility for need-based financial aid. A lower SAI generally means you’re eligible for more aid.

-

Q: Can I still apply for financial aid if I miss the FAFSA deadline?

A: While you can still apply, you may miss out on certain types of aid, especially state and institutional aid, which often have earlier deadlines. Always prioritize applying as early as possible.

-

Q: What’s the difference between subsidized and unsubsidized loans?

A: Subsidized loans are need-based, and the government pays the interest while you’re in school at least half-time and during deferment periods. Unsubsidized loans are not need-based, and you’re responsible for paying the interest from the time the loan is disbursed.

-

Q: How do scholarships affect my financial aid package?

A: Scholarships are considered a resource and can reduce your need for other types of aid, such as loans. However, they can significantly reduce your overall cost of attendance.

-

Q: What happens if my family’s financial situation changes after I submit the FAFSA?

A: Contact UCR’s Financial Aid Office. They may be able to make professional judgment adjustments to your FAFSA based on your changed circumstances.

-

Q: How does living on or off campus affect my financial aid?

A: Your cost of attendance, which is used to determine your financial aid eligibility, varies depending on whether you live on or off campus. Living off campus may result in a lower cost of attendance and, therefore, potentially less financial aid.

-

Q: What is verification, and why was I selected for it?

A: Verification is a process where the Financial Aid Office asks you to provide documentation to verify the information you reported on your FAFSA. You may be selected for verification randomly or because of inconsistencies in your application.

-

Q: How can I appeal my financial aid award?

A: If you believe your financial aid award is not sufficient to cover your educational expenses, you can submit an appeal to UCR’s Financial Aid Office. Be sure to provide documentation to support your appeal.

-

Q: What resources are available for students with disabilities seeking financial aid?

A: Students with disabilities may be eligible for additional financial aid resources, such as grants and scholarships specifically for students with disabilities. Contact UCR’s Disability Resource Center for more information.

Conclusion: Securing Your Future with UCR and the FAFSA

Understanding and utilizing the UCR FAFSA code (001316) is a crucial step in accessing the financial aid you need to pursue your academic goals at the University of California, Riverside. By following the steps outlined in this guide, avoiding common mistakes, and taking advantage of the resources available to you, you can navigate the FAFSA process with confidence and secure the financial support you deserve.

Remember, financial aid is an investment in your future. By taking the time to understand the process and explore your options, you can make informed decisions about financing your education and setting yourself up for success. Don’t hesitate to reach out to UCR’s Financial Aid Office for assistance – they are there to help you every step of the way. Good luck, and we hope to see you thriving at UCR!

Share your experiences with the FAFSA in the comments below. What challenges did you face, and what tips do you have for other students? Let’s build a community of support and help each other navigate the financial aid process.