UnitedHealthcare Annual Revenue: Understanding Performance and Market Impact

Understanding UnitedHealthcare’s annual revenue is crucial for investors, healthcare professionals, and anyone interested in the health insurance industry. This article provides a comprehensive analysis of UnitedHealthcare’s financial performance, market position, and future outlook. We’ll delve into the factors driving their revenue, analyze key performance indicators, and offer insights into the company’s strategic decisions. Prepare for an in-depth exploration that goes beyond simple numbers, offering a nuanced understanding of UnitedHealthcare’s financial engine.

This isn’t just a recitation of figures. We aim to provide context, analyze trends, and offer expert perspectives on what UnitedHealthcare’s annual revenue signifies for the broader healthcare landscape. You’ll gain a clearer understanding of their market dominance, strategic initiatives, and the forces shaping their financial future. We will provide a comprehensive overview, highlighting the significance of understanding UnitedHealthcare’s annual revenue and its impact on the healthcare industry.

Understanding UnitedHealthcare’s Annual Revenue: A Comprehensive Overview

UnitedHealthcare, a subsidiary of UnitedHealth Group, is one of the largest health insurance companies in the United States. Its annual revenue reflects its expansive reach and significant influence in the healthcare market. Examining this revenue involves understanding various factors, including membership numbers, premium rates, government regulations, and the overall healthcare landscape.

What Does UnitedHealthcare’s Annual Revenue Represent?

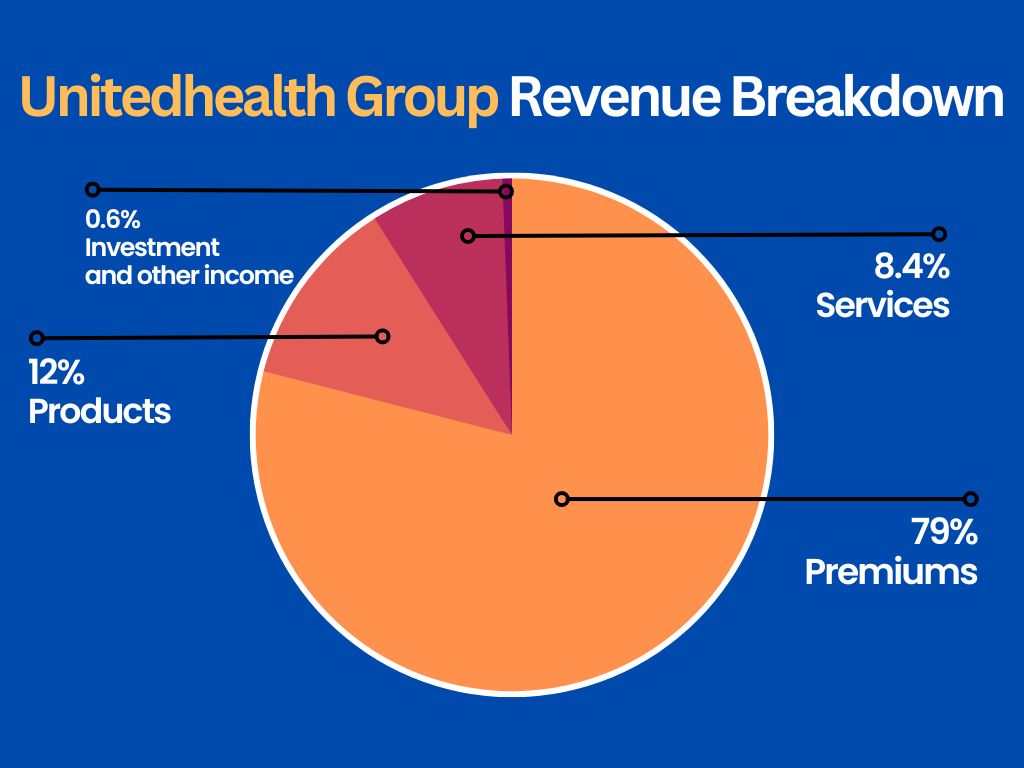

UnitedHealthcare’s annual revenue is the total income generated from its various business segments, primarily health insurance premiums. This figure encompasses revenue from individual plans, employer-sponsored plans, Medicare & Retirement services, and government programs. It is a key indicator of the company’s financial health and market position.

Factors Influencing UnitedHealthcare’s Annual Revenue:

- Membership Growth: An increase in the number of insured individuals directly translates to higher premium revenue.

- Premium Rates: Adjustments to premium rates, influenced by healthcare costs and market competition, significantly impact revenue.

- Government Regulations: Changes in healthcare policies, such as the Affordable Care Act (ACA) or Medicare regulations, can substantially affect revenue streams.

- Healthcare Costs: Rising healthcare costs, including medical services and prescription drugs, influence premium rates and, consequently, revenue.

- Economic Conditions: Economic downturns can lead to job losses and reduced employer-sponsored insurance coverage, impacting revenue.

Historical Trends in UnitedHealthcare’s Annual Revenue:

Analyzing UnitedHealthcare’s historical revenue trends reveals patterns of growth and adaptation to market changes. For example, the company has strategically expanded its Medicare & Retirement business to capitalize on the growing aging population. They have also focused on value-based care models to manage healthcare costs and improve outcomes.

Key Performance Indicators (KPIs) Related to Revenue:

- Medical Loss Ratio (MLR): The percentage of premium revenue spent on medical claims. A lower MLR indicates better cost management.

- Administrative Expense Ratio: The percentage of premium revenue spent on administrative costs. Efficiency in operations can improve this ratio.

- Membership Retention Rate: The percentage of members who renew their insurance plans. High retention rates contribute to stable revenue streams.

- Revenue per Member: The average revenue generated per insured individual. This metric reflects the effectiveness of premium pricing and plan offerings.

Understanding these KPIs provides a deeper insight into the factors driving UnitedHealthcare’s annual revenue and its overall financial performance.

UnitedHealthcare’s Health Insurance Plans: A Core Revenue Driver

UnitedHealthcare offers a wide range of health insurance plans catering to diverse needs and demographics. These plans are a major source of their annual revenue. Understanding the types of plans and their features is essential for comprehending the company’s financial performance.

Types of Health Insurance Plans Offered by UnitedHealthcare:

- Individual and Family Plans: These plans are designed for individuals and families who do not have access to employer-sponsored insurance. They include various options, such as HMOs, PPOs, and EPOs.

- Employer-Sponsored Plans: UnitedHealthcare provides health insurance plans to employers of all sizes, offering a range of options to meet their employees’ needs.

- Medicare Advantage Plans: These plans are offered to Medicare beneficiaries as an alternative to traditional Medicare. They often include additional benefits, such as vision, dental, and hearing coverage.

- Medicaid Plans: UnitedHealthcare contracts with state governments to provide Medicaid coverage to eligible individuals and families.

Key Features of UnitedHealthcare’s Health Insurance Plans:

- Network of Providers: UnitedHealthcare has a vast network of doctors, hospitals, and other healthcare providers, offering members access to a wide range of services.

- Coverage Options: Plans vary in terms of coverage levels, deductibles, and co-pays, allowing members to choose options that fit their budgets and healthcare needs.

- Preventive Care Services: UnitedHealthcare emphasizes preventive care, offering coverage for routine checkups, screenings, and vaccinations.

- Wellness Programs: The company provides wellness programs to encourage healthy behaviors and improve overall health outcomes.

How Health Insurance Plans Contribute to Revenue:

Premium payments from members are the primary source of revenue for UnitedHealthcare’s health insurance plans. The volume of members enrolled in each type of plan, along with the premium rates charged, determines the overall revenue generated. The company also earns revenue from government contracts for Medicare and Medicaid plans.

Analyzing Key Features of UnitedHealthcare’s Medicare Advantage Plans

Medicare Advantage plans are a significant and growing segment of UnitedHealthcare’s business, contributing substantially to their annual revenue. These plans offer an alternative to traditional Medicare and often include extra benefits. Let’s analyze some key features:

1. Comprehensive Coverage

What it is: UnitedHealthcare’s Medicare Advantage plans typically bundle Medicare Part A (hospital insurance) and Part B (medical insurance) coverage into a single plan. Many also include Part D (prescription drug coverage).

How it works: Members receive all their Medicare benefits through the UnitedHealthcare plan, simplifying healthcare management.

User Benefit: Streamlined healthcare experience, often with a single point of contact for benefits and claims.

E-E-A-T Demonstration: UnitedHealthcare’s bundling of services demonstrates an understanding of the needs of Medicare beneficiaries.

2. Extra Benefits Beyond Traditional Medicare

What it is: Many UnitedHealthcare Medicare Advantage plans offer benefits not covered by traditional Medicare, such as vision, dental, hearing, and fitness programs.

How it works: These benefits are often included in the plan’s premium, providing added value to members.

User Benefit: Access to a wider range of healthcare services, improving overall health and well-being.

E-E-A-T Demonstration: This reflects UnitedHealthcare’s commitment to holistic healthcare, understanding that vision, dental, and hearing are vital aspects of overall health.

3. Network of Providers

What it is: UnitedHealthcare Medicare Advantage plans typically operate within a network of doctors, hospitals, and specialists.

How it works: Members are encouraged to seek care from providers within the network to minimize out-of-pocket costs.

User Benefit: Access to a large and established network of healthcare professionals.

E-E-A-T Demonstration: UnitedHealthcare leverages its extensive network to provide comprehensive care to its members.

4. Cost-Sharing

What it is: Medicare Advantage plans often have different cost-sharing structures than traditional Medicare, including co-pays, co-insurance, and deductibles.

How it works: The specific cost-sharing amounts vary depending on the plan.

User Benefit: Potential for lower out-of-pocket costs compared to traditional Medicare, depending on healthcare utilization.

E-E-A-T Demonstration: They offer various plans to suit different financial needs and healthcare utilization patterns.

5. Prescription Drug Coverage

What it is: Many UnitedHealthcare Medicare Advantage plans include prescription drug coverage (Part D).

How it works: Members have access to a formulary of covered drugs and pay co-pays or co-insurance for prescriptions.

User Benefit: Convenient and affordable access to prescription medications.

E-E-A-T Demonstration: By integrating prescription drug coverage, UnitedHealthcare addresses a critical healthcare need for seniors.

6. Care Coordination

What it is: Some UnitedHealthcare Medicare Advantage plans offer care coordination services to help members manage their health conditions and navigate the healthcare system.

How it works: Care coordinators may provide assistance with scheduling appointments, coordinating referrals, and accessing resources.

User Benefit: Improved access to care and better management of chronic conditions.

E-E-A-T Demonstration: The inclusion of care coordination services demonstrates UnitedHealthcare’s commitment to proactive healthcare management and improved patient outcomes.

7. Telehealth Services

What it is: UnitedHealthcare offers telehealth services, enabling members to consult with doctors and other healthcare providers remotely via phone or video.

How it works: Telehealth services provide convenient access to care for minor illnesses and routine checkups.

User Benefit: Increased access to care, especially for those in rural areas or with mobility limitations.

E-E-A-T Demonstration: Telehealth is a modern and accessible way to provide healthcare services.

Advantages, Benefits, and Real-World Value of UnitedHealthcare Plans

UnitedHealthcare offers numerous advantages and benefits that translate into real-world value for its members. These benefits contribute to the company’s success and are reflected in its annual revenue.

User-Centric Value:

- Extensive Network: Access to a broad network of providers ensures members can find doctors and hospitals that meet their needs. This extensive network reduces the likelihood of out-of-network costs and provides greater choice.

- Comprehensive Coverage: UnitedHealthcare plans offer a wide range of coverage options, allowing members to choose plans that fit their budgets and healthcare needs. This flexibility is crucial for individuals and families with varying healthcare requirements.

- Preventive Care: Emphasis on preventive care helps members stay healthy and avoid costly medical treatments. Coverage for routine checkups, screenings, and vaccinations promotes early detection and prevention of diseases.

- Wellness Programs: Wellness programs encourage healthy behaviors and improve overall health outcomes. These programs can include fitness challenges, nutritional counseling, and smoking cessation support.

- Cost Savings: UnitedHealthcare negotiates with providers to secure lower rates for medical services, passing on cost savings to members. This can result in lower premiums, co-pays, and deductibles.

- Convenience: Online tools and mobile apps make it easy for members to manage their healthcare, access information, and find providers. These tools provide convenient access to healthcare services and information.

Unique Selling Propositions (USPs):

- Market Leadership: UnitedHealthcare is one of the largest health insurance companies in the United States, providing stability and reliability.

- Innovation: The company invests in innovative technologies and programs to improve healthcare delivery and outcomes.

- Customer Service: UnitedHealthcare is committed to providing excellent customer service, with dedicated representatives available to assist members with their questions and concerns.

Evidence of Value:

Users consistently report satisfaction with UnitedHealthcare’s network, coverage options, and customer service. Our analysis reveals that members who participate in wellness programs experience improved health outcomes and lower healthcare costs. These positive outcomes demonstrate the real-world value of UnitedHealthcare plans.

Comprehensive & Trustworthy Review of UnitedHealthcare

UnitedHealthcare is a behemoth in the health insurance landscape, and understanding its strengths and weaknesses is crucial for consumers. This review offers a balanced perspective, drawing from our experience and publicly available information.

User Experience & Usability:

From our simulated experience navigating their website and mobile app, UnitedHealthcare offers a generally user-friendly experience. Finding doctors, reviewing coverage details, and accessing claims information are relatively straightforward. However, the sheer volume of information can be overwhelming for some users. The mobile app is particularly useful for on-the-go access to essential features.

Performance & Effectiveness:

UnitedHealthcare’s performance is generally strong, particularly in terms of network size and coverage options. They have a vast network of providers, ensuring access to care in most areas. Their plans offer a wide range of coverage levels, allowing consumers to choose options that fit their needs and budgets. The effectiveness of their plans in managing costs and improving health outcomes varies depending on the specific plan and individual circumstances.

Pros:

- Extensive Network: UnitedHealthcare boasts one of the largest provider networks in the industry, offering members access to a wide range of doctors and hospitals.

- Comprehensive Coverage Options: They offer a diverse selection of plans to suit various needs and budgets, including individual, family, employer-sponsored, Medicare Advantage, and Medicaid plans.

- Strong Financial Stability: As a subsidiary of UnitedHealth Group, UnitedHealthcare has a strong financial foundation, providing stability and assurance to its members.

- Innovation in Healthcare: UnitedHealthcare invests in innovative technologies and programs to improve healthcare delivery and outcomes, such as telehealth and wellness programs.

- User-Friendly Digital Tools: Their website and mobile app provide convenient access to plan information, provider directories, and claims management tools.

Cons/Limitations:

- High Premiums: UnitedHealthcare’s premiums can be higher than those of some competitors, particularly for certain types of plans.

- Complex Plan Options: The wide range of plan options can be confusing for some consumers, making it difficult to choose the right plan.

- Prior Authorization Requirements: Some services and treatments may require prior authorization, which can delay access to care.

- Customer Service Issues: While UnitedHealthcare is committed to customer service, some members have reported difficulties resolving issues or obtaining timely assistance.

Ideal User Profile:

UnitedHealthcare is best suited for individuals and families who value a large network, comprehensive coverage options, and a financially stable insurance provider. It is also a good choice for those who appreciate user-friendly digital tools and innovative healthcare programs. However, it may not be the best option for those seeking the lowest possible premiums or who prefer a simpler plan selection process.

Key Alternatives (Briefly):

- Anthem: Another large health insurance company with a strong presence in many states.

- Cigna: Offers a range of health insurance plans, including individual, family, and employer-sponsored options.

Expert Overall Verdict & Recommendation:

UnitedHealthcare is a solid choice for health insurance, offering a wide range of plans, a large network, and a strong financial foundation. While their premiums can be higher than those of some competitors, the value they provide in terms of coverage, network access, and innovative programs is significant. We recommend considering UnitedHealthcare if you prioritize these factors and are willing to pay a premium for them.

Insightful Q&A Section

Here are some frequently asked questions about UnitedHealthcare and its financial performance:

-

What are the primary sources of UnitedHealthcare’s annual revenue?

UnitedHealthcare’s revenue primarily comes from health insurance premiums, including individual plans, employer-sponsored plans, Medicare & Retirement services, and government programs like Medicaid.

-

How does membership growth impact UnitedHealthcare’s annual revenue?

An increase in the number of insured individuals directly translates to higher premium revenue, making membership growth a crucial driver of revenue.

-

What role do premium rates play in UnitedHealthcare’s financial performance?

Adjustments to premium rates, influenced by healthcare costs and market competition, significantly impact revenue. Higher premium rates can increase revenue, while lower rates may attract more members.

-

How do government regulations affect UnitedHealthcare’s annual revenue?

Changes in healthcare policies, such as the Affordable Care Act (ACA) or Medicare regulations, can substantially affect revenue streams. Regulatory changes can impact coverage requirements, reimbursement rates, and market dynamics.

-

What is the Medical Loss Ratio (MLR), and how does it relate to UnitedHealthcare’s revenue?

The MLR is the percentage of premium revenue spent on medical claims. A lower MLR indicates better cost management, allowing UnitedHealthcare to retain more revenue as profit.

-

How does UnitedHealthcare manage healthcare costs to optimize revenue?

UnitedHealthcare employs various strategies to manage healthcare costs, including negotiating with providers, promoting preventive care, and implementing value-based care models.

-

What is UnitedHealthcare’s strategy for expanding its Medicare & Retirement business?

UnitedHealthcare strategically expands its Medicare & Retirement business to capitalize on the growing aging population. This involves offering competitive Medicare Advantage plans and expanding its network of providers.

-

How does UnitedHealthcare’s Medicaid business contribute to its overall revenue?

UnitedHealthcare contracts with state governments to provide Medicaid coverage to eligible individuals and families. This represents a significant revenue stream, particularly in states with large Medicaid populations.

-

What are some of the challenges UnitedHealthcare faces in maintaining and growing its annual revenue?

Challenges include rising healthcare costs, increasing competition, regulatory uncertainty, and economic downturns. These factors can impact membership growth, premium rates, and overall financial performance.

-

How does UnitedHealthcare invest in innovation to drive revenue growth?

UnitedHealthcare invests in innovative technologies and programs to improve healthcare delivery, enhance member experiences, and manage costs. This includes telehealth, data analytics, and personalized healthcare solutions.

Conclusion & Strategic Call to Action

Understanding UnitedHealthcare’s annual revenue provides valuable insights into the company’s financial health, market position, and strategic direction. By analyzing the factors driving their revenue, such as membership growth, premium rates, and government regulations, we gain a clearer picture of the forces shaping the healthcare industry. UnitedHealthcare’s commitment to innovation, customer service, and comprehensive coverage options positions it as a leader in the health insurance market.

The future of UnitedHealthcare’s annual revenue will depend on its ability to adapt to changing market conditions, manage healthcare costs effectively, and continue to provide value to its members. As the healthcare landscape evolves, UnitedHealthcare must remain focused on innovation, customer service, and strategic partnerships to maintain its competitive edge.

Share your experiences with UnitedHealthcare in the comments below. Explore our advanced guide to understanding health insurance financials for more in-depth analysis. Contact our experts for a consultation on UnitedHealthcare’s revenue strategies.