Where Is My Minnesota Tax Refund? Your Ultimate Guide to Tracking Your MN Refund

Waiting for your Minnesota tax refund and wondering, “where is my Minnesota tax refund?” You’re not alone! This comprehensive guide provides everything you need to know about tracking your Minnesota state tax refund, understanding potential delays, and what to do if you encounter problems. We’ll walk you through the official resources, explain common reasons for delays, and offer expert tips to ensure a smoother refund process. This is your one-stop resource for finding out where is my Minnesota tax refund.

Understanding the Minnesota Tax Refund Process

The Minnesota Department of Revenue processes millions of tax returns each year. Understanding the process can help you estimate when you might receive your refund and identify potential issues early on. The processing timeline typically begins once you’ve filed your return, whether electronically or by mail. Electronic filing generally results in faster processing times compared to paper returns.

The state verifies the information on your return against various databases and sources to ensure accuracy and prevent fraud. This verification process can sometimes lead to delays, especially if there are discrepancies or missing information.

Key Factors Affecting Refund Processing Time

- Filing Method: E-filing is generally faster than mailing a paper return.

- Accuracy of Information: Errors or omissions can cause delays.

- Return Complexity: More complex returns with multiple schedules or deductions may take longer to process.

- Security Reviews: The Minnesota Department of Revenue conducts security reviews to prevent fraud, which can add to the processing time.

- Volume of Returns: During peak tax season, processing times may be longer due to the high volume of returns being processed.

Official Resources for Tracking Your Minnesota Tax Refund

The Minnesota Department of Revenue provides several official resources to help you track your refund. These resources are the most reliable sources of information and should be your first stop when checking on your refund status.

The “Where’s My Refund?” Online Tool

The easiest and most convenient way to track your Minnesota tax refund is through the Department of Revenue’s online “Where’s My Refund?” tool. To use this tool, you’ll need the following information:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): The SSN or ITIN of the primary taxpayer listed on the return.

- Tax Year: The year for which you filed the return (e.g., 2024 for the 2024 tax year).

- Refund Amount: The exact amount of the refund you’re expecting.

Once you enter this information, the tool will provide you with the current status of your refund. It will typically show one of the following statuses:

- Return Received: The Department of Revenue has received your tax return and it is being processed.

- Refund Approved: Your refund has been approved and is scheduled to be issued.

- Refund Issued: Your refund has been issued, either by direct deposit or by mail.

- Additional Information Needed: The Department of Revenue requires additional information to process your return.

Contacting the Minnesota Department of Revenue

If you’re unable to track your refund online or have questions about your refund status, you can contact the Minnesota Department of Revenue directly. Here’s how:

- Phone: Call the Department of Revenue’s individual income tax line. Be prepared to provide your SSN, tax year, and other identifying information.

- Email: You can submit an inquiry through the Department of Revenue’s website. However, be aware that email communication may not be as secure as other methods.

- Mail: You can send a written inquiry to the Department of Revenue. This method is generally the slowest and should only be used if other options are not available.

When contacting the Department of Revenue, be patient and polite. Representatives are often dealing with a high volume of inquiries, especially during tax season.

Common Reasons for Minnesota Tax Refund Delays

Several factors can cause delays in receiving your Minnesota tax refund. Understanding these potential issues can help you anticipate and address them proactively.

Errors or Omissions on Your Tax Return

One of the most common reasons for refund delays is errors or omissions on your tax return. These can include:

- Incorrect Social Security Number: Ensure that your SSN and those of your dependents are entered correctly.

- Incorrect Bank Account Information: Double-check your bank account number and routing number for direct deposit.

- Missing Schedules or Forms: Include all required schedules and forms with your return.

- Math Errors: Verify all calculations on your return.

Before submitting your return, carefully review all information to minimize the risk of errors.

Identity Theft or Fraud Prevention

The Minnesota Department of Revenue takes identity theft and fraud prevention seriously. If your return is flagged for potential fraud, it may be subject to additional review, which can delay your refund.

Common red flags that can trigger a fraud review include:

- Suspicious Filing Patterns: Filing a return with unusual deductions or credits.

- Multiple Returns Filed from the Same Address: This can raise concerns about identity theft.

- Changes in Filing Behavior: Suddenly claiming a large refund after years of not doing so.

If your return is flagged for fraud, you may be asked to provide additional documentation to verify your identity and the accuracy of your return. This can include copies of your driver’s license, Social Security card, and W-2 forms.

Review by the Minnesota Department of Revenue

The Minnesota Department of Revenue may review your return for various reasons, even if there are no apparent errors or red flags. This review can be random or triggered by specific factors, such as:

- Complex Deductions or Credits: Returns with complex deductions or credits, such as business expenses or energy credits, may be subject to review.

- High Income or Assets: Returns with high income or assets may be reviewed to ensure compliance with tax laws.

- Changes in Tax Law: The Department of Revenue may review returns to ensure that taxpayers are complying with new or updated tax laws.

If your return is selected for review, you may be asked to provide additional documentation to support your claims. Be prepared to respond promptly and thoroughly to any requests from the Department of Revenue.

What to Do If Your Minnesota Tax Refund Is Delayed

If you’ve been waiting longer than expected for your Minnesota tax refund, here are some steps you can take to investigate the delay and potentially expedite the process.

Check the “Where’s My Refund?” Tool Regularly

The “Where’s My Refund?” tool is the best source of up-to-date information about your refund status. Check it regularly for any changes or updates. If the tool indicates that additional information is needed, respond promptly to the Department of Revenue’s request.

Contact the Minnesota Department of Revenue

If the “Where’s My Refund?” tool doesn’t provide enough information or if you have specific questions about your refund, contact the Minnesota Department of Revenue directly. Be prepared to provide your SSN, tax year, and other identifying information. Ask for clarification on the reason for the delay and what steps you can take to resolve it.

Gather Supporting Documentation

If the Department of Revenue requests additional documentation, gather it as quickly as possible. This may include copies of your W-2 forms, 1099 forms, receipts, and other documents that support the information on your tax return. Organize your documents clearly and label them appropriately.

Consider Filing an Amended Return

If you discover an error on your tax return after you’ve filed it, you may need to file an amended return. This can correct the error and potentially expedite your refund. Use Form M1X, Amended Income Tax. Filing an amended return can take additional time to process, so it’s important to correct any errors as soon as possible.

Minnesota Tax Refund FAQs

1. How long does it typically take to receive a Minnesota tax refund?

Typically, Minnesota tax refunds are issued within a few weeks of filing electronically. Paper returns can take significantly longer, often several months. The exact timeframe depends on the complexity of your return and the Department of Revenue’s workload.

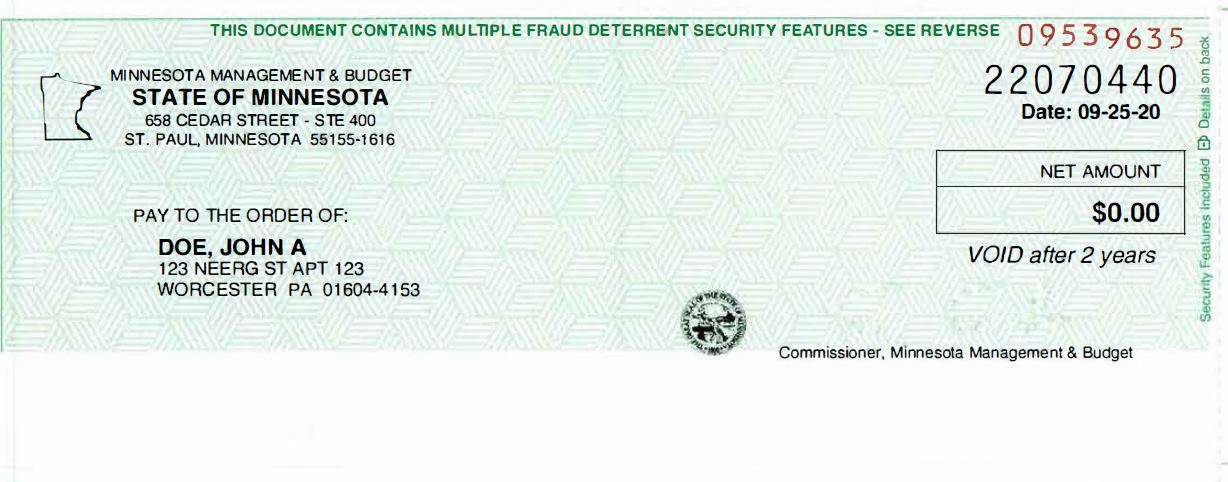

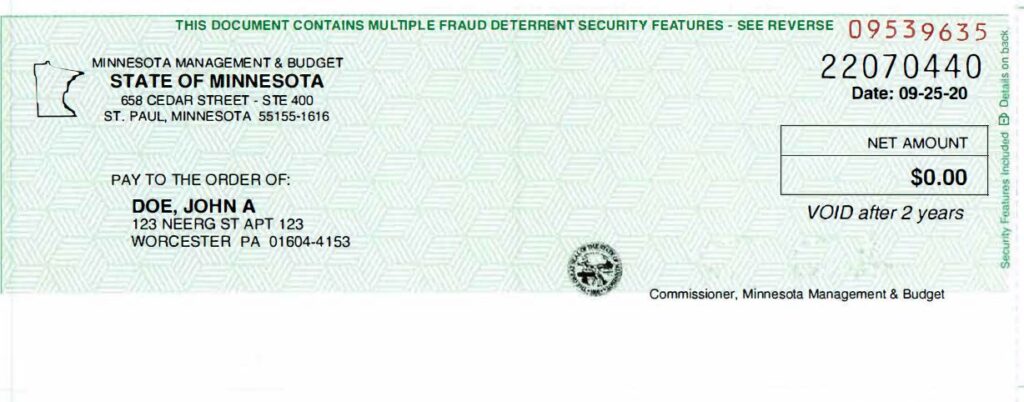

2. What if I moved after filing my tax return?

If you moved after filing your return, update your address with the Minnesota Department of Revenue. You can do this online or by mail. This ensures that your refund check is mailed to the correct address.

3. Can I track my refund if I filed a paper return?

Yes, you can track your refund even if you filed a paper return. Use the “Where’s My Refund?” tool on the Minnesota Department of Revenue’s website. You’ll need your SSN, tax year, and refund amount.

4. What happens if my refund is offset for a debt?

Your Minnesota tax refund may be offset if you owe certain debts, such as unpaid taxes, child support, or student loans. The Department of Revenue will notify you if your refund is being offset.

5. Is there a way to expedite my refund?

The best way to expedite your refund is to file electronically, ensure your return is accurate, and respond promptly to any requests from the Department of Revenue. There’s no guaranteed way to speed up the process, but these steps can help.

6. What if I never receive my refund check?

If you never receive your refund check, contact the Minnesota Department of Revenue. They can investigate the issue and potentially reissue the check. Be prepared to provide your SSN, tax year, and other identifying information.

7. Can I get my refund deposited into multiple bank accounts?

No, the Minnesota Department of Revenue can only deposit your refund into one bank account. Make sure to provide the correct account number and routing number when filing your return.

8. What if I filed jointly and my spouse has a debt?

If you filed jointly and your spouse has a debt, your refund may be offset to pay that debt. You may be able to file an injured spouse claim to recover your portion of the refund.

9. How do I know if my return has been selected for review?

The Minnesota Department of Revenue will notify you if your return has been selected for review. You may receive a letter or email requesting additional information.

10. What are the most common mistakes that cause refund delays?

Common mistakes that cause refund delays include incorrect SSNs, incorrect bank account information, missing schedules or forms, and math errors. Review your return carefully before submitting it to avoid these mistakes.

Conclusion: Taking Control of Your Minnesota Tax Refund

Understanding the Minnesota tax refund process and knowing where is my Minnesota tax refund is crucial for a smooth and timely refund. By utilizing the official resources, avoiding common errors, and responding promptly to any requests from the Department of Revenue, you can increase your chances of receiving your refund without delay. Remember to file electronically, double-check your information, and stay informed about the status of your refund. If you still have questions, consider reaching out to a qualified tax professional for personalized guidance. Your proactive approach will ensure a stress-free tax season and put that refund back in your pocket where it belongs. Share your experiences with tracking your Minnesota tax refund in the comments below!